Reimbursement opportunities may exist that you are unaware of—possibly tied to unclaimed property in your name. In this guide, you will learn how to navigate the Unclaimed Property Reimbursement Form, ensuring that you take the necessary steps to recover any assets owed to you. Understanding the process can empower you to reclaim your lost funds effectively while avoiding common pitfalls that could hinder your reimbursement efforts. Get ready to unlock potential financial benefits with your knowledge and action!

Types of Unclaimed Property

Your journey to reclaim unclaimed property begins with understanding the different types that may be out there waiting for you. Unclaimed property can range from financial accounts to tangible personal possessions. Here’s a brief overview of the most common types:

- Financial Accounts

- Personal Property

- Insurance Benefits

- Stocks and Bonds

- Uncashed Checks

| Type of Unclaimed Property | Description |

|---|---|

| Financial Accounts | Inactive accounts, such as bank or brokerage accounts, that have had no activity for a specified time. |

| Personal Property | Physical items like jewelry, collectibles, or estate items that have not been claimed. |

| Insurance Benefits | Life insurance policies or benefits that remain unclaimed by the beneficiaries. |

| Stocks and Bonds | Investment accounts that have transferred to the state due to inactivity. |

| Uncashed Checks | Checks issued by businesses or government agencies that were never cashed. |

Financial Accounts

Unclaimed financial accounts can often include bank savings or checking accounts, credit union accounts, or brokerage accounts that have been inactive for a certain period—typically three to five years. If you haven’t touched your account in a while, it may be turned over to the state as unclaimed property.

Personal Property

There’s a diverse range of personal property that can become unclaimed, including items like jewelry, art, and various collectibles. While these belongings may seem sentimental, they are classified as unclaimed property if they sit in a safe deposit box or estate that has not been accessed for years.

It is crucial to be aware that unclaimed personal property can be auctioned off or retained by the state if you do not claim it within a specific time frame. This process can lead to the loss of valuable items that could have both financial and emotional significance. Moreover, retrieving such assets often requires navigating a procedural maze, including providing documentation and proving ownership. Thus, remaining proactive in tracking personal belongings is crucial, lest they become permanently unavailable to you.

Knowing the types of unclaimed property can help you better understand what might be waiting for you out there.

Tips for Completing the Reimbursement Form

The process of filling out the Unclaimed Property Reimbursement Form can seem daunting, but following a few tips can ease the stress and ensure your submission is successful. Here are some crucial tips to keep in mind:

- Provide accurate personal information so your claim can be processed without delays.

- Be thorough in explaining the details of your unclaimed property to avoid complications.

- Keep a copy of everything you submit for your own records.

- Follow the instructions step-by-step to ensure all requirements are met.

- Check for any deadlines to submit your form and keep those dates in mind.

Assume that diligence in these steps will lead to a smoother reimbursement process.

Gather Required Documentation

You will need to gather all necessary documents to support your claim for unclaimed property. This may include identification, proof of ownership, and any related correspondence or documents that can help validate your claim. Having these in order before you start filling out the form will save you time and reduce any potential errors.

Double-Check Information

For any form submission, particularly the Unclaimed Property Reimbursement Form, it’s vital to carefully double-check all information entered. Even small mistakes can lead to processing delays or denials of your claim.

Plus, examining your details thoroughly helps ensure that your personal information, such as your name and address, is accurate. A typo could result in your claim being sent to the wrong location or rejected entirely. Additionally, ensure that any identification numbers and descriptions of the property are correct and match the documents you have provided. This due diligence is crucial in expediting your reimbursement process, so be meticulous yet efficient as you complete your form.

Step-by-Step Process for Filing

Little is more frustrating than dealing with unclaimed property issues, but filing for reimbursement doesn’t have to be. This section breaks down the entire process into manageable steps to help you claim what is rightfully yours. Follow these steps to ensure your reimbursement application is successfully submitted.

| Steps | Description |

|---|---|

| 1. Gather Required Information | Collect all relevant documentation, including identification, proof of ownership, and any prior claims. |

| 2. Access the Reimbursement Form | Locate the correct form on your state’s unclaimed property website or contact the appropriate agency. |

| 3. Fill Out the Form | Carefully complete the form, ensuring all information is accurate and detailed. |

| 4. Submit the Form | Follow the instructions for submission, including deadlines and preferred methods. |

| 5. Monitor Your Claim | Keep track of your submission status and be prepared to provide additional information if requested. |

Accessing the Reimbursement Form

While finding the right reimbursement form can seem daunting, it’s a straightforward process. Visit your state’s unclaimed property website to locate the necessary forms. Many states offer downloadable PDF versions, or you can fill out the form online. Ensure you’re on the official government site to avoid scams and access accurate information.

Submitting the Form

Accessing the submission process is equally important; it usually involves sending your completed reimbursement form to the designated agency. Each state has different requirements, so make sure you’re sending it to the right place using the specified method, whether by mail or electronically.

Plus, make sure you include any required supporting documentation when you submit your form. Incomplete forms or missing documentation can lead to delays in processing your claim. Keep copies of everything you send and note the submission date. If your state allows online submissions, this might expedite the process. Recall, knowing the right steps can significantly increase your chances of successfully reclaiming your property.

Factors to Consider

To successfully navigate the unclaimed property reimbursement form process, there are several factors you should consider:

- Type of Property: Understand what particular assets may be unclaimed, such as bank accounts or insurance benefits.

- State Regulations: Each state has its own rules regarding unclaimed property and reimbursement.

- Documentation Needed: Be prepared to provide identification and any supporting documents when submitting your claim.

- Filing Deadlines: Keep track of any deadlines to ensure your claim is accepted.

- Potential Fees: Be wary of any fees associated with filing a claim or hiring a recovery service.

After considering these factors, you’ll be better equipped to handle the unclaimed property reimbursement process efficiently.

Timelines for Reimbursement

One of the key elements to keep in mind is the timeline for reimbursement. Each state has specific processing times that can range from a few weeks to several months, depending on the volume of claims and specific circumstances surrounding your case.

Eligibility Criteria

Timelines can significantly influence your eligibility criteria for reimbursement. The basic requirements often involve proof of ownership, along with documentation that connects you to the unclaimed property. It’s crucial to have the appropriate forms filled and submitted in accordance with state guidelines.

For instance, some states may require that you provide not only your identification but also specific documents like bank statements or tax returns to demonstrate your claim. If you’re unable to provide the required documentation, your claim might be denied, which underscores the importance of meticulous preparation. Moreover, staying updated on eligibility requirements can drastically impact your chances of reclaiming your unclaimed property successfully.

Not Just Free Money: Pros and Cons of Claiming Unclaimed Property

| Pros | Cons |

|---|---|

| Possibility of receiving funds you didn’t know existed. | The claims process can be time-consuming and complex. |

| No cost to file a claim, as it is often a free service. | Some properties may have expired or are no longer available. |

| Unclaimed properties can include cash, bonds, and other assets. | Fraudulent claims could arise, complicating legitimate claims. |

| State agencies offer support throughout the claims process. | Inaccurate records may lead to delays in verification. |

| Ability to claim funds from multiple sources at once. | The potential for fees if using third-party services to assist. |

| Increased awareness of your financial situation. | Expectations may not be met if the amount claimed is less than anticipated. |

| Opportunity to learn about various financial assets. | Claiming process can be overwhelming without guidance. |

| Can help you reconnect with lost assets from previous accounts. | Limited time to claim some properties before they are forfeited. |

| Can positively impact your financial literacy. | Success isn’t guaranteed, leading to potential disappointment. |

| May bring peace of mind, knowing all your assets are accounted for. | Some states may have different rules regarding unclaimed property. |

Advantages of Filing a Claim

An advantage of filing a claim for unclaimed property is the potential to access funds you were previously unaware of. These assets can range from old bank accounts to forgotten insurance policies, providing you with unexpected financial support. Additionally, the process is generally free, and state agencies are dedicated to assisting you in verifying and claiming your property, making it a worthwhile endeavor.

Potential Drawbacks

Unclaimed property can bring opportunities, but it also has its drawbacks. The claims process can be convoluted and require a substantial investment of your time and energy without a guaranteed outcome. Furthermore, if documents are missing or records are inaccurate, this could further complicate your claim.

Potential issues with claiming unclaimed property include the risk of encountering fraudulent claims in the system, which can delay your legitimate process. Additionally, some items may have been forfeited due to deadlines or incomplete documentation, leaving you frustrated. While many people have successfully claimed benefits, it’s crucial to weigh these potential pitfalls against the advantages to make an informed decision.

Summing up

Following this discussion, you should now have a clearer understanding of the Unclaimed Property Reimbursement Form and its significance in reclaiming assets that may belong to you. By completing this form, you can initiate the process of recovering money or property that has lain dormant, ensuring that your rightful ownership is recognized. Be diligent in gathering the necessary documentation and providing accurate information to facilitate a smooth reimbursement process. Recall, reclaiming unclaimed property can provide a vital financial boost, so don’t hesitate to take action if you believe you have a claim.

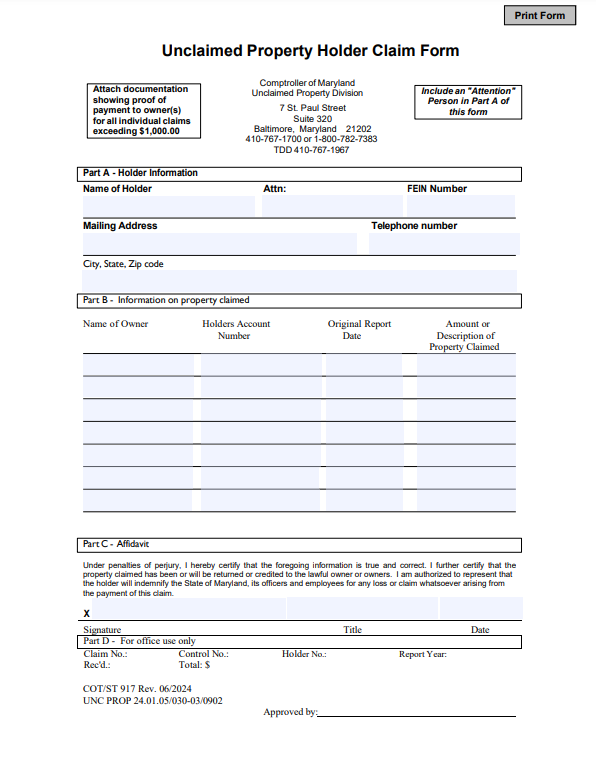

Download Unclaimed Property Reimbursement Form

Unclaimed Property Reimbursement Form: A Comprehensive Guide

Unclaimed property refers to assets that have been abandoned or forgotten, such as bank accounts, insurance policies, or uncashed checks. When these properties remain unclaimed for a certain period, they often become subject to state laws that govern their handling. One avenue for individuals to reclaim their belongings is through an Unclaimed Property Reimbursement Form. In this article, we probe into what this form entails, its significance, and how you can successfully navigate the process of claiming your unclaimed property.

What is an Unclaimed Property Reimbursement Form?

An Unclaimed Property Reimbursement Form is a legal document that individuals or businesses can file to reclaim property that has been deemed unclaimed by the state. Typically, these forms are filled out when the rightful owner wishes to retrieve funds or assets that are being held by the state due to inactivity or lack of response. The form generally requires detailed information, including personal identification, evidence of ownership, and any relevant transaction history.

Why is it Important to File This Form?

Filing the Unclaimed Property Reimbursement Form is crucial because it helps protect your rights as the original owner of the property. If you do not file the form within the specified time frame, you risk losing your property to the state, which will often take ownership of the unclaimed assets after a set period. By submitting this form, you initiate the process of reclaiming what is rightfully yours, ensuring that you don’t lose out on your financial assets.

How Can I Submit an Unclaimed Property Reimbursement Form?

Submitting an Unclaimed Property Reimbursement Form typically involves a few steps. First, locate the appropriate form for your state, as each state may have its specific requirements and procedures. Once you have filled out the form with accurate information, compile any necessary documentation, such as identification and proof of ownership. Then, you can submit the form via mail, online platforms, or in person at your state’s unclaimed property office. It’s important to keep copies of everything you submit for your records.

FAQ

Q: How do I know if I have unclaimed property?

A: To determine if you have unclaimed property, you can conduct a search through state databases that list unclaimed assets. Most states allow individuals to search using their names or business names online. It’s recommended to check periodically, as unclaimed property lists are updated regularly. Additionally, you might receive notifications from the state if they are in possession of your unclaimed assets.

Q: What information do I need to provide when filling out the Unclaimed Property Reimbursement Form?

A: When filling out the Unclaimed Property Reimbursement Form, you will typically need to provide personal identification details, such as your name, address, and Social Security number. Additionally, it’s crucial to include any identification numbers associated with the unclaimed property, documentation showing proof of ownership (like account statements or property deeds), and a detailed description of the property. Ensuring that all information is accurate will streamline the claims process.

Q: What happens after I submit the Unclaimed Property Reimbursement Form?

A: After submitting the Unclaimed Property Reimbursement Form, your application will be reviewed by the appropriate state authorities. They may take a few weeks to process your claim, during which they will verify the information provided. If your claim is approved, you will receive instructions on how to obtain your funds or property. In case of denial, you will typically receive an explanation, and you may have the option to appeal the decision, depending on state law.

To conclude, understanding the unclaimed property reimbursement process is critical for individuals looking to reclaim their assets. By being proactive and knowledgeable about the forms and procedures, you can successfully retrieve what is rightfully yours.