Reimbursement through your Flexible Spending Account (FSA) can save you money on eligible health expenses, but navigating the process can be complicated. In this guide, you will learn how to properly fill out the FSA reimbursement form to maximize your benefits and avoid potential pitfalls. Understanding the required documentation and deadlines is crucial to ensuring your claims are processed smoothly and efficiently. By following these steps, you can confidently access the funds you need for your medical expenses, making the most of your FSA while enhancing your financial well-being.

Understanding FSA Reimbursement Forms

Before exploring into the reimbursement process, it’s vital to grasp the specifics of Flexible Spending Accounts (FSAs) and how their reimbursement forms function. By understanding these forms, you can maximize your benefits and ensure a seamless reimbursement experience.

Types of FSA Reimbursement Forms

Forms vary depending on the specific use of your FSA funds. Generally, there are several types of reimbursement forms available:

- Health Care FSA Forms

- Dependent Care FSA Forms

- Limited Purpose FSA Forms

- General Purpose FSA Forms

- Over-the-Counter (OTC) Forms

Any of these forms may be required depending on your particular FSA needs.

| Type of Form | Description |

| Health Care FSA | Used for medical expenses such as prescriptions and doctor visits. |

| Dependent Care FSA | Covers costs for child and dependent care, allowing you to work or look for work. |

| Limited Purpose FSA | Primarily for dental and vision expenses, often used with Health Savings Accounts. |

| General Purpose FSA | Can be utilized for a wide range of eligible expenses. |

| Over-the-Counter (OTC) | For qualified OTC medications and supplies without prescriptions. |

Common Uses of FSA Funds

Reimbursement requests generally stem from various health-related expenses. You can utilize FSA funds for a wide array of vital costs.

Reimbursement options are critical for managing your healthcare expenses. You can use your FSA funds for medical visits, prescription medications, dental care, and vision treatments. This flexibility can be advantageous, but it’s important to keep track of your eligible expenses to avoid missing out on tax savings. Notably, using FSA funds for eligible expenses can keep your out-of-pocket health costs down, allowing you to save considerably over the year. However, be cautious with your claims, as misuse can lead to penalties. Always keep your receipts and follow the guidelines to ensure proper reimbursement. Your proactive management will help you maximize these valuable funds.

Tips for Efficiently Filling Out the Form

While navigating the FSA reimbursement process can be a bit overwhelming, there are several tips that can help you complete the FSA reimbursement form efficiently and accurately. Here’s how you can streamline the process:

- Read the form carefully before starting.

- Gather all necessary documentation ahead of time.

- Double-check your personal information for accuracy.

- Clearly itemize each expense for clarity.

- Follow the submission guidelines specific to your FSA plan.

Any extra time spent preparing in advance will save you from setbacks later.

Required Documentation

Even if you think you’ve provided all necessary information, the required documentation can often be a vital aspect of your FSA reimbursement. Typically, this includes receipts, invoices, or a statement of service that clearly shows the date, type of service, and payment amount. Always ensure that the documentation meets your plan’s specific criteria for a smoother reimbursement experience.

Common Mistakes to Avoid

Documentation of your expenses is crucial in the FSA reimbursement process, and there are several common mistakes you should be aware of. Many people often fail to submit clear and itemized receipts, which can lead to delays or denials of their claims. Additionally, not adhering to the submission deadlines can also jeopardize your reimbursement eligibility.

Avoid the pitfalls of missing receipts and unclear documentation. Most importantly, remember to keep copies of everything you submit and review the instructions for your specific FSA plan thoroughly. Failing to provide the required details or submitting claims late can result in your hard-earned dollars going unclaimed. Always check your work to ensure a smooth and efficient reimbursement process.

Step-by-Step Guide for Submission

Even the most complex processes can become manageable when broken down into straightforward steps. When submitting your FSA reimbursement form, it’s necessary to clearly understand each stage to ensure a smooth experience. Below is a step-by-step guide to help you through the process effectively.

| Step | Description |

|---|---|

| 1 | Gather your necessary information. |

| 2 | Complete the reimbursement form accurately. |

| 3 | Submit your claim to your plan administrator. |

Gathering Necessary Information

There’s a vital first step in the process: gathering all relevant documentation. Before completing your FSA reimbursement form, ensure you have receipts, invoices, and any additional information that validates your expenses. Having this information ready will make filling out the form much easier and increase the likelihood of a successful claim.

Completing the Reimbursement Form

Clearly outline all necessary details as you fill out your reimbursement form. Include your name, contact information, the date of service, and a description of the purchased items or services. Provide accurate amounts and attach supporting documents to ensure your claim is processed swiftly.

Form completion is critical to avoid delays. Check for any discrepancies and ensure every section of the form is filled out accurately. Make note of required documentation, including receipts that show the date, service, and payment amount. Don’t hesitate to double-check your entries; an accurate form is crucial for prompt reimbursement.

Submitting Your Claim

Little details can make a significant difference when submitting your claim. Ensure that you submit your completed form along with all supporting documents as per your plan administrator’s guidelines. Any missing information could lead to delays in reimbursement.

Step-by-step submission is key. After filling out your FSA reimbursement form, cross-reference your submission with the requirements outlined by your plan. A well-prepared submission will help expedite processing time and enhance the likelihood of receiving your funds without hassle.

Factors to Consider Before Submission

Not all FSA reimbursement forms are created equal. Before you hit that submit button, it’s important to keep the following factors in mind to ensure a smooth reimbursement process:

- Eligibility: Ensure the expenses you’re claiming are eligible for reimbursement under your plan.

- Documentation: Gather all necessary receipts and documentation required for your submission.

- Timing: Be aware of submission deadlines to avoid losing out on funds.

- Plan Limits: Check your plan limits to understand how much you can claim.

- Completeness: Double-check your forms for accuracy and completeness before submission.

Perceiving these factors can significantly impact the success of your reimbursement process.

Eligibility Criteria

Assuming you want to submit for FSA reimbursement, the first step is to evaluate the eligibility criteria. Each plan has specific guidelines that outline which expenses qualify for reimbursement. Commonly eligible expenses include medical treatments, prescription medications, and qualifying over-the-counter items. However, always refer to your plan’s specifics to avoid any surprises.

Submission Deadlines

For a successful FSA reimbursement claim, you must adhere to strict submission deadlines. Most plans require you to submit your claims within a specific timeframe after the incurred expenses, typically within 30 to 90 days. Failing to meet these deadlines could result in forfeiting your claim or even your available funds.

The deadlines for submission usually align with your plan year, meaning you may have a grace period of up to 2.5 months past the end of the year to submit claims. However, it’s crucial to note that some plans require claims to be submitted by the end of the year for reimbursement. Staying organized and marking your calendar with these dates will help you avoid missing out on valuable compensation.

FSA Reimbursement Form: Pros and Cons

Despite the numerous advantages of utilizing Flexible Spending Accounts (FSAs), it is crucial to consider both the benefits and potential drawbacks associated with using an FSA reimbursement form. Below is a breakdown of the pros and cons to help you make informed decisions regarding your healthcare spending.

Pros and Cons of Using an FSA Reimbursement Form

| Pros | Cons |

|---|---|

| Tax savings on eligible expenses | Use-it-or-lose-it policy can result in lost funds |

| Allows for reimbursement of out-of-pocket costs | Requires careful tracking of receipts and expenses |

| Can cover a wide range of medical expenses | May require additional documentation |

| Promotes proactive healthcare spending | Enrollment limitations may apply annually |

| Offers flexibility in managing health expenses | May complicate your tax filing process |

Advantages of FSA Reimbursements

The FSA reimbursement form is a powerful tool that offers you numerous benefits, including the ability to save on taxes while effectively managing healthcare costs. By allowing you to use pre-tax dollars for qualified medical expenses, you can maximize your purchasing power and promote a healthier lifestyle. Ultimately, this ensures that you can receive crucial medical services without the financial burden associated with out-of-pocket expenses.

Potential Disadvantages

Using an FSA reimbursement form does come with certain drawbacks that you should be aware of. While FSAs offer tax advantages, they also have specific limitations that might affect your overall experience.

Reimbursement can be complicated, especially if you do not keep accurate records of your eligible expenses or fail to submit your claims on time. Additionally, the use-it-or-lose-it policy means that you risk losing any unspent funds at the end of the plan year. This can create pressure to quickly use your allocated funds, which could lead to hasty and potentially unnecessary purchases. It’s crucial to carefully assess your expected healthcare needs and manage your FSA wisely to avoid these pitfalls.

Final Words

Presently, understanding the FSA reimbursement form is crucial for maximizing your benefits. By accurately completing this form, you ensure that your eligible medical expenses are reimbursed promptly, allowing you to take full advantage of your flexible spending account. Remember to keep all necessary documentation, such as receipts and invoices, as these will support your claims. Whether submitting online or via mail, following the guidelines will streamline the process and mitigate delays. Stay informed about your plan’s specifics to optimize your healthcare spending effectively.

Download FSA Reimbursement Form

FSA Reimbursement Form: Everything You Need to Know

Flexible Spending Accounts (FSAs) are tax-advantaged financial accounts that can be used for medical expenses. To get reimbursed for eligible expenses, individuals must submit an FSA Reimbursement Form. In this article, we will explore the purpose of the FSA Reimbursement Form, how to fill it out properly, and some key deadlines to keep in mind.

What is an FSA Reimbursement Form?

The FSA Reimbursement Form is a document that individuals use to request the reimbursement of qualified medical expenses from their Flexible Spending Account. When employees incur out-of-pocket healthcare costs, they can fill out this form to claim their money back, helping them manage their healthcare expenses more effectively.

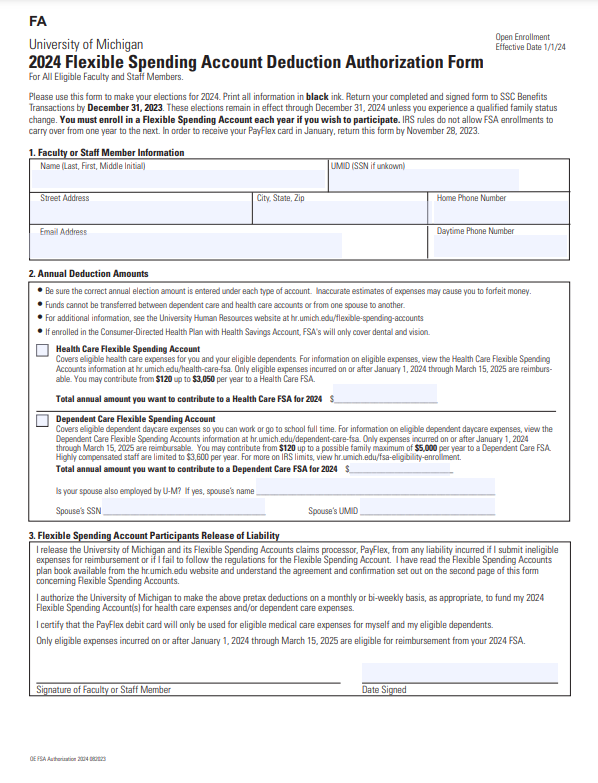

How to Fill Out the FSA Reimbursement Form?

Filling out the FSA Reimbursement Form involves several key steps:

- Personal Information: Start by entering your name, address, phone number, and the last four digits of your Social Security Number.

- Expense Details: List the qualified expenses incurred, including the date of service, the amount, and a brief description of the service.

- Receipts: Attach copies of receipts or Explanation of Benefits (EOB) from your insurance provider for the expenses you are claiming.

- Signature: Sign and date the form to certify that the expenses are eligible and have not been reimbursed already.

When Should You Submit the FSA Reimbursement Form?

Most FSAs operate on a “use-it-or-lose-it” basis, meaning funds not used within the plan year may be forfeited. Therefore, it is crucial to keep track of deadlines. Typically, you should submit your FSA Reimbursement Form:

- During the Plan Year: For expenses incurred during the current calendar year, generally before the end of the year.

- Grace Period: Some plans allow a grace period of up to 2.5 months into the new year for expenses to be reimbursed.

- Run-Out Period: After the plan year ends or the grace period, there might be a run-out period (usually 90 days) to submit claims for reimbursement.

FAQ

Q: What types of expenses can I claim using the FSA Reimbursement Form?

A: You can claim a wide array of eligible medical expenses such as co-pays, prescription medications, dental and orthodontic work, vision care like glasses or contact lenses, and mental health counseling. Each FSA plan has a list of eligible expenses, so be sure to review these to ensure your claims are valid.

Q: How long does it take to get reimbursed after submitting the FSA Reimbursement Form?

A: Once your FSA Reimbursement Form has been submitted and received by your plan administrator, the reimbursement procedure typically takes about 7 to 14 business days. Processing times can vary based on the plan administrator, so it’s advisable to check with them for specific timelines.

Q: What if I submit the FSA Reimbursement Form after the deadline?

A: If you submit your FSA Reimbursement Form after the established deadline, unfortunately, your claim may be denied, and you could forfeit those funds. It’s crucial to keep track of submission deadlines specific to your FSA plan to avoid losing your eligible reimbursement.

To put it briefly, the FSA Reimbursement Form is a vital tool for managing your healthcare expenses efficiently. By understanding how to use it, keeping track of deadlines, and knowing which expenses qualify, you can make the most out of your Flexible Spending Account.