Are you struggling to navigate the process of submitting a dental reimbursement claim with Metlife? Don’t worry, you’re not alone! Filing a claim can be overwhelming, but with the right guidance, you can ensure that you receive the reimbursement you deserve for your dental expenses. In this guide, we will walk you through the step-by-step process of completing the Metlife dental reimbursement form, highlighting important deadlines, required documentation, and common mistakes to avoid. By the end of this article, you’ll be confident in submitting your claim and getting the reimbursement you need.

Understanding Metlife Dental Reimbursement Form Types

For a seamless dental care experience, it’s vital to understand the different types of Metlife dental reimbursement forms. You’ll need to know which form to use, depending on your specific situation and plan details.

The main types of Metlife dental reimbursement forms include:

- In-Network Reimbursement Form: For dentists within Metlife’s network

- Out-of-Network Reimbursement Form: For dentists outside Metlife’s network

- International Reimbursement Form: For dental care received outside the United States

- Orthodontic Reimbursement Form: For orthodontic treatments

- Pediatric Reimbursement Form: For pediatric dental care

This breakdown will help you navigate the process with ease.

| Form Type | Description |

|---|---|

| In-Network Reimbursement Form | For dentists within Metlife’s network |

| Out-of-Network Reimbursement Form | For dentists outside Metlife’s network |

| International Reimbursement Form | For dental care received outside the United States |

| Orthodontic Reimbursement Form | For orthodontic treatments |

In-Network vs. Out-of-Network Reimbursement

Likewise, understanding the difference between in-network and out-of-network reimbursement is crucial. In-network dentists have agreed to Metlife’s fee schedule, resulting in lower out-of-pocket costs for you. Out-of-network dentists, on the other hand, may charge higher fees, leaving you with a larger bill.

Different Plan Options and Their Reimbursement Structures

InNetwork with Metlife, you’ll find various plan options, each with its own reimbursement structure. Some plans may have higher premiums but offer more comprehensive coverage, while others may have lower premiums but more limited coverage.

Plan options can be overwhelming, but it’s vital to choose the one that best fits your needs and budget. For example, if you need orthodontic treatment, you may want to opt for a plan that offers more comprehensive coverage for this type of care. On the other hand, if you’re looking for a more affordable option, you may want to consider a plan with a lower premium and more limited coverage.

Important note: Be sure to review your plan details carefully to understand your reimbursement structure and any limitations or exclusions that may apply.

Tips for Filling Out the Metlife Dental Reimbursement Form

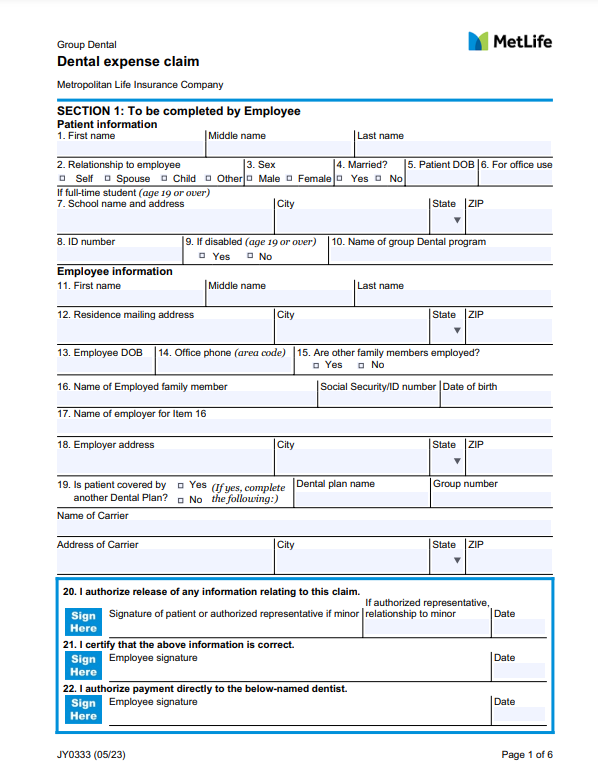

Now that you have the Metlife dental reimbursement form, it’s imperative to fill it out correctly to ensure a smooth and timely reimbursement process. Here are some valuable tips to help you navigate the form:

- Read the instructions carefully before starting to fill out the form to avoid any confusion.

- Fill out the form completely and accurately to prevent delays.

- Attach all required documents, including receipts, invoices, and treatment plans.

- Double-check your math to ensure accuracy in calculating your reimbursement amount.

- Keep a copy of the completed form and supporting documents for your records.

The more attention you pay to these details, the faster you’ll receive your reimbursement.

Gathering Required Documents and Information

Meticulously gather all necessary documents, including your dental treatment plan, receipts, and invoices, to support your reimbursement claim. Make sure you have all the required information, such as your policy number, date of service, and dentist’s information, before filling out the form.

Avoiding Common Mistakes and Delays

Form inaccuracies and incomplete submissions are common mistakes that can lead to delays in your reimbursement. Make sure to review your form carefully before submitting it.

Mistakes such as incomplete or missing information, math errors, and unsigned forms can cause significant delays. Take your time to review the form, and if you’re unsure about anything, contact Metlife’s customer service for assistance. By being diligent and thorough, you can avoid these common mistakes and ensure a smooth reimbursement process.

A Step-by-Step Guide to Submitting the Form

There’s no need to feel overwhelmed when submitting your Metlife dental reimbursement form. By following these simple steps, you’ll be able to get your claim processed quickly and efficiently.

| Step | Description |

|---|---|

| 1 | Complete the form: Fill out the Metlife dental reimbursement form accurately and thoroughly, making sure to include all required information and supporting documentation. |

| 2 | Review and sign: Carefully review the form for any errors or omissions, then sign and date it. |

| 3 | Submit the form: Choose your preferred method of submission, either online, by mail, or by fax. |

Online Submission Process

Now that you’ve completed the form, you can submit it online through Metlife’s e-claims portal. Simply log in to your account, upload the required documents, and click submit. You’ll receive an instant confirmation that your claim has been received.

Mailing or Faxing the Form

Some people prefer to submit their forms through traditional means. If you choose to mail or fax your form, make sure to include all required documents and keep a copy for your records.

StepbyStep, it’s vital to ensure that you’re sending your form to the correct address or fax number. You can find this information on Metlife’s website or by contacting their customer service department. Remember to use certified mail or a fax confirmation to ensure that your form is received.

Remember to keep a copy of your submitted form and supporting documents for your records. If you have any questions or concerns, don’t hesitate to reach out to Metlife’s customer service department for assistance.

Factors Affecting Reimbursement Amounts

Not all dental procedures are created equal, and the reimbursement amount you receive from MetLife will depend on various factors. These factors can significantly impact the amount you receive, so it’s necessary to understand them.

- Type of procedure: Different procedures have different reimbursement rates. For example, a routine cleaning may have a higher reimbursement rate than a more complex procedure like a crown.

- Location: The location where you receive treatment can also impact reimbursement amounts. Urban areas may have higher reimbursement rates than rural areas.

- Dentist’s fees: Your dentist’s fees can also affect reimbursement amounts. If your dentist charges higher fees, you may receive a lower reimbursement amount.

The factors mentioned above can significantly impact the reimbursement amount you receive, so it’s crucial to review your policy and understand what’s covered.

Deductibles and Co-Pays

Along with the procedure type, another factor affecting reimbursement amounts is the deductible and co-pay amounts. An necessary aspect of your dental insurance policy, deductibles and co-pays can reduce the reimbursement amount you receive. Make sure you understand your policy’s deductible and co-pay requirements to avoid any surprises.

Annual Maximums and Frequency Limits

While reviewing your policy, pay attention to the annual maximums and frequency limits. These limits can restrict the number of times you can receive reimbursement for a particular procedure within a year.

The annual maximum is the maximum amount MetLife will pay for dental expenses within a year. Frequency limits, on the other hand, restrict the number of times you can receive reimbursement for a specific procedure. For example, you may only be able to receive reimbursement for a cleaning twice a year. Understanding these limits is crucial to avoid any unexpected costs.

Important note: Make sure to review your policy carefully to understand the annual maximums and frequency limits to avoid any surprises.

Weighing the Pros and Cons of Metlife Dental Reimbursement

Your decision to use Metlife Dental Reimbursement Form depends on various factors, including the benefits and drawbacks of the program. To help you make an informed decision, we’ve broken down the pros and cons into a simple table:

| Pros | Cons |

|---|---|

| Flexible reimbursement options | Limited coverage for certain procedures |

| Wide network of participating dentists | Annual maximum benefit limits apply |

| No waiting periods for preventive care | Pre-authorization required for some services |

| Easy online claims submission | Deductibles and copays apply to certain services |

| 24/7 customer support | Some services may not be covered |

| Personalized dental health planning | Maximum age limits for certain services |

| Discounts for preventive care | Some providers may not accept Metlife insurance |

| Customizable plan options | Premium costs may be high for some plans |

| Easy access to dental health resources | Complex claims process for some services |

Benefits of Using Metlife Dental Reimbursement

With Metlife Dental Reimbursement, you can enjoy flexible reimbursement options, a wide network of participating dentists, and no waiting periods for preventive care. These benefits allow you to focus on your dental health without worrying about the financial burden.

Drawbacks and Limitations of the Program

Little do people know that Metlife Dental Reimbursement has some drawbacks, including limited coverage for certain procedures, annual maximum benefit limits, and deductibles and copays for certain services. These limitations can impact your overall dental care experience.

Understanding these drawbacks is crucial to making the most of your Metlife Dental Reimbursement Form. For instance, some services may not be covered, and you may need to pay out-of-pocket for them. Additionally, pre-authorization is required for some services, which can delay your treatment. By being aware of these limitations, you can plan your dental care accordingly and avoid any surprises.

Conclusion

Following this guide, you should now have a comprehensive understanding of the MetLife dental reimbursement form and how to navigate its submission process. By accurately filling out the form and providing the necessary documentation, you can ensure a smooth and timely reimbursement for your dental expenses. Remember to carefully review your policy and the form’s instructions to avoid any potential delays or errors. With this knowledge, you can confidently manage your dental care costs and focus on maintaining a healthy, happy smile.

Download Metlife Dental Reimbursement Form

Frequently Asked Questions about MetLife Dental Reimbursement Form

Q: What is the MetLife Dental Reimbursement Form and why do I need to submit it?

The MetLife Dental Reimbursement Form is a document required by MetLife, a leading provider of dental insurance, to process reimbursement claims for dental treatments and services. You need to submit this form to request reimbursement for dental expenses incurred during a specific period. The form helps MetLife to verify your eligibility, determine the coverage, and process the payment accordingly. It’s necessary to submit the form accurately and timely to avoid delays or denials in your reimbursement.

Q: What information do I need to provide on the MetLife Dental Reimbursement Form?

The MetLife Dental Reimbursement Form typically requires the following information:

- Your personal details, including name, address, and contact information

- Dental provider’s information, including name, address, and tax ID number

- Detailed description of the dental services or treatments received, including dates and costs

- Your insurance policy number and group number (if applicable)

- Original receipts or invoices for the dental services or treatments

Make sure to attach all supporting documents and provide accurate information to ensure prompt processing of your claim.

Q: How do I submit the MetLife Dental Reimbursement Form and what is the typical processing time?

You can submit the MetLife Dental Reimbursement Form online through MetLife’s website, or mail it to the address specified on the form. It’s recommended to keep a copy of the form and supporting documents for your records. The typical processing time for reimbursement claims varies, but MetLife usually processes claims within 7-10 business days from the receipt of the completed form. You can track the status of your claim online or contact MetLife’s customer service for updates.

By understanding the purpose, requirements, and submission process of the MetLife Dental Reimbursement Form, you can ensure a smooth and efficient reimbursement experience. Remember to carefully review the form and attach all necessary documents to avoid delays or denials.