Medicare reimbursements can often be a daunting task, but you don’t have to tackle it alone. This guide will walk you through the vital steps and nuances of the Medicare Reimbursement Claim Form, ensuring that you understand how to complete it correctly to avoid any delays in processing your claims. By following these straightforward instructions, you will be equipped with the knowledge to maximize your benefits and effectively navigate the often complex world of Medicare claims.

Types of Medicare Reimbursement Claim Forms

To understand the Medicare reimbursement claim forms, it’s vital to know the different types available. Each form is tailored to specific plans within the Medicare program, which includes Original Medicare, Medicare Advantage, and Medicare Part D. Here’s a brief overview of these forms:

| Type of Claim Form | Description |

|---|---|

| Original Medicare Claim Form | Used for reimbursement under traditional Medicare coverage. |

| Medicare Advantage Plan Claim Form | Applicable for members utilizing private insurance plans. |

| Medicare Part D Claim Form | For costs related to prescription medications. |

| Out-of-Network Claims | Claims for services received outside the Medicare network. |

| Emergency Services Claims | Used when emergency services are needed and a submission is required afterwards. |

Any type of claim form needs to be filled out correctly to ensure you receive your reimbursements efficiently.

Original Medicare Claim Forms

Medicare claim forms for Original Medicare are typically submitted on the CMS-1500 or UB-04 forms. These forms are designed for healthcare providers to bill Medicare for services rendered. When you receive services from a provider who accepts Medicare, they often handle the submission for you. If not, you can submit the form yourself by providing necessary documentation.

Medicare Advantage Plan Claim Forms

Claim forms for your Medicare Advantage Plan vary by insurer. These plans often have additional rules regarding reimbursements, making the submission process crucial. You need to check with your specific plan to determine the correct forms and processes required.

This means that while some Advantage Plans may cover out-of-network services, the claim submission process could differ significantly from Original Medicare. Additionally, insurers might require specific information or documentation to process your claims, so staying informed is vital for a smoother reimbursement experience.

Medicare Part D Claim Forms

Claim forms related to Medicare Part D are vital for prescription drug-related reimbursements. You must submit a Medicare Part D claim form if you have out-of-pocket expenses for medications not covered by your plan.

With the rise in prescription costs, ensuring accurate submissions using the Part D claim forms can lead to significant savings. You need to keep all receipts and records of medications, as these will be necessary to support your claim. Always verify that the form aligns with your plan’s specific requirements to avoid delays or denials in reimbursement.

Any Medicare reimbursement process is vital for ensuring that you receive the benefits entitled to you. Being knowledgeable about the types of claim forms and the submission process will empower you to navigate the complexities of Medicare with confidence.

Step-by-Step Guide to Completing the Claim Form

Even though the Medicare reimbursement claim process can seem overwhelming, taking it step-by-step can simplify the task significantly. Below is a structured guide that will help you understand how to complete the claim form effectively.

Table of Steps

| Step | Action |

|---|---|

| 1 | Gather necessary information |

| 2 | Filling out the form correctly |

| 3 | Submitting the claim |

Gathering Necessary Information

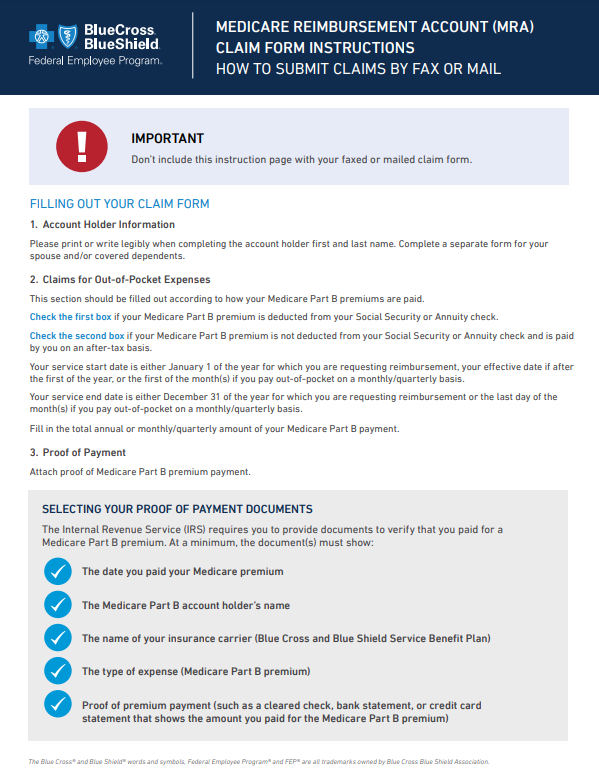

For a successful claim submission, start by gathering all the necessary information. This includes your Medicare number, patient demographics, provider details, service dates, and related medical documentation. Obtaining these details before filling out the form will save you time and reduce errors.

Filling Out the Form Correctly

Claiming your reimbursement is crucial, so ensure you fill out the form correctly. Double-check each entry for accuracy, especially your Medicare number and service codes, as mistakes could delay processing or result in claim denial.

Information such as the type of therapy received or medical procedures performed must match what is provided by your healthcare provider. Use clear and concise language, and make sure to refer to the official instructions provided with the claim form for precise guidance.

Submitting the Claim

An vital part of the reimbursement process is submitting the claim accurately and on time. Make sure all necessary documents are included, and check for any required signatures to avoid delays.

The submission process can vary, as you can send your completed claim form by mail, or in some cases, electronically. Always keep a copy of the claim form and any associated documents for your records, as this can be vital for follow-ups or addressing issues that may arise.

Key Factors Influencing Reimbursement

Once again, understanding the key factors influencing reimbursement can significantly enhance your success with the Medicare Reimbursement Claim Form. Numerous elements come into play when determining whether your claim will be accepted and paid in a timely manner. Here are some crucial factors to keep in mind:

- Timeliness of Submission

- Completeness of Documentation

- Eligibility Criteria

Recognizing these factors can help streamline your claims process and improve your reimbursement outcomes.

Timeliness of Submission

The prompt submission of your Medicare claim is vital. Submitting your claim within the designated time frame ensures that it is processed without delay. Generally, you should aim to submit your claim within 12 months from the date of service to avoid any potential denials.

Completeness of Documentation

Some key aspects of your claim documentation can make or break your reimbursement success. Ensure all necessary information is included, such as patient details, treatment codes, and provider information.

Another important aspect to consider regarding completeness is that incomplete documentation often leads to delays or denials. When preparing your claim, double-check that every section is filled accurately and relevant supporting documents are attached, such as medical records or notes. This meticulous approach will minimize the likelihood of complications and facilitate easier approval.

Eligibility Criteria

You must thoroughly understand the eligibility criteria for Medicare claims. Each service or treatment must meet specific guidelines to qualify for reimbursement.

With various eligibility requirements in place, staying informed about changes or updates to Medicare policies is crucial. Ensure that both you and your patients meet the necessary qualifications for coverage. Failing to adhere to these criteria can result in claim denials, causing unnecessary complications for you and your practice. By regularly reviewing these requirements, you can provide the best service while ensuring smooth reimbursement processes.

Tips for Successful Claims

Many individuals find the process of submitting a Medicare reimbursement claim form to be daunting. However, by following these effective tips, you can increase your chances of successful claims:

- Ensure all personal information is accurate.

- Attach all necessary supporting documentation.

- Stay informed about your coverage limits.

- Submit your claims as soon as you receive the services.

- Keep copies of everything for your records.

Knowing the key steps can facilitate smoother interaction with the Medicare system throughout the claim process.

Double-Checking Information

The accuracy of your information significantly impacts the outcome of your claim. Make sure to meticulously review every detail before submission, including your name, insurance number, and the codes for the services provided. Even minor discrepancies can lead to delays or denials.

Understanding Coverage Limits

You need to be aware of the coverage limits associated with your Medicare plan. Knowing what services are covered and the maximum limits can prevent unwelcome surprises during the claims process.

Another important aspect of understanding coverage limits is recognizing the different types of Medicare plans (A, B, C, and D) and what they entail. Each plan has specific rules regarding covered services, deductibles, and co-payments. Familiarize yourself with your policy to ensure you are claiming for eligible services only.

Following Up on Claims

On completing your claim submission, it’s crucial to follow up regularly. Tracking the status of your claim can help identify any issues that may arise and prompt timely resolutions.

Tips for following up include setting reminders to check on your claim status and maintaining open communication with your Medicare representative. If delays occur, be persistent and inquire about the reasons to understand how to resolve any outstanding issues effectively.

Medicare Reimbursement Claim Form

Unlike private insurance processes, filing for Medicare reimbursement claims has its own set of advantages and disadvantages. Understanding these can help you navigate the system more effectively and ensure you’re making the most out of your healthcare benefits. Below is a breakdown of the pros and cons to consider as you proceed with filing your claims.

Pros and Cons of Medicare Reimbursement Claims

| Pros | Cons |

|---|---|

| Comprehensive coverage for seniors | Complex process can be confusing |

| Protects against high medical costs | Potential delays in reimbursement |

| No lifetime coverage limits | Need for detailed documentation |

| Wide range of covered services | Some services may require prior authorization |

| Quality of care from healthcare providers | Can be difficult to understand benefits |

| Access to preventive services | Appealing denied claims can be time-consuming |

| Annual open enrollment period | Some claims may be underpaid |

| Cost-sharing options available | Restrictions on certain medications and treatments |

| Support resources available | Involvement of multiple parties can complicate the process |

| Potential for lower out-of-pocket costs | Limited coverage for long-term care |

Benefits of Filing Claims

Filing Medicare claims can offer you substantial benefits, including access to a wide range of healthcare services and protection against excessive medical expenses. This federal program is designed to help you maintain your health without the fear of depleting your financial resources. With no lifetime coverage limits, you can receive the treatment necessary without worrying about reaching a cap on your benefits.

Potential Drawbacks and Challenges

Cons of Medicare reimbursement claims can lead to understandably frustrating experiences. The complexity of the processes often leaves you grappling with a confusing landscape of requirements and regulations.

Challenges like understanding the specific requirements for documentation and potential delays in reimbursement can place stress on you during a time when you’re focused on your health. Furthermore, appealing denied claims can be particularly time-consuming. It’s vital to stay organized and keep thorough records of your medical services to mitigate complications. Ultimately, being informed and prepared can help you navigate these potential obstacles effectively.

Conclusion

Presently, understanding the Medicare reimbursement claim form is necessary for ensuring you receive the appropriate coverage and benefits for your healthcare expenses. By familiarizing yourself with the necessary documentation and procedures, you can expedite the claims process and minimize financial burdens. Always double-check your submissions for accuracy and completeness, as this can significantly impact the timeliness and success of your reimbursement. Stay informed and proactive in managing your Medicare claims to secure the best outcomes for your health needs.

Download Medicare Reimbursement Claim Form

FAQ

Q: What is a Medicare Reimbursement Claim Form?

A: The Medicare Reimbursement Claim Form, also known as the CMS-1500 form, is a document used by healthcare providers to bill Medicare for services rendered to patients. When a Medicare beneficiary receives medical treatment, the provider fills out this form to request reimbursement from Medicare for the costs of the services provided. The form includes details about the patient, the provider, the services performed, and any other relevant information to support the claim. It is crucial for ensuring that providers are paid for their services under the Medicare program.

Q: How do I fill out the Medicare Reimbursement Claim Form correctly?

A: Filling out the Medicare Reimbursement Claim Form requires attention to detail. First, ensure that you have all necessary information, including the patient’s Medicare number, date of service, diagnosis codes, and procedure codes. Begin by entering the patient’s information in the designated sections, followed by provider details. It’s crucial to use the correct diagnosis and procedure codes, which can be found in the ICD-10 and CPT code books respectively. Lastly, review the form to check for any inaccuracies or missing information before submitting it to Medicare for reimbursement.

Q: What should I do if my Medicare reimbursement claim is denied?

A: If your Medicare reimbursement claim is denied, the first step is to carefully review the denial notice from Medicare, which will outline the reasons for the denial. Common reasons include incorrect information, missing documentation, or services not covered under Medicare. If you believe the claim was denied in error, you can appeal the decision using the appeals process outlined in the notice. This typically involves submitting a formal request for reconsideration, providing any additional documentation or clarification needed to support your case. It’s advisable to act promptly, as there are deadlines for filing appeals.