There’s a crucial aspect of health management that often goes overlooked: the Medical Reimbursement Form. Understanding this form is crucial for you to reclaim your hard-earned money spent on medical expenses. By accurately completing this document, you can ensure that your insurance provider reimburses eligible medical costs effectively. In this guide, you’ll learn about the details required, potential pitfalls to avoid, and tips to streamline the process, allowing you to maximize your reimbursements without unnecessary delays.

Types of Medical Reimbursement Forms

To understand the different types of medical reimbursement forms available, it’s necessary to recognize their functions and uses within the healthcare system. Each type serves a specific purpose and caters to various healthcare providers and patients. Below is a breakdown of some common types of forms:

| Type of Form | Description |

|---|---|

| Standard Medical Claim Forms | General forms used by most healthcare providers for reimbursement. |

| Electronic Medical Reimbursement Forms | Digital versions of claim forms submitted electronically. |

| Specialty-Specific Reimbursement Forms | Forms tailored for specific medical specialties. |

| Claim Adjustment Forms | Used to request changes or corrections to previously submitted claims. |

| Patient Reimbursement Forms | Forms utilized by patients to claim expenses from their insurance. |

Standard Medical Claim Forms

On your journey through the healthcare system, you will likely encounter standard medical claim forms. These are the most widely used forms, enabling healthcare providers to request payment from insurance companies for the services rendered to patients. They often include details like diagnosis codes, treatment dates, and provider information, ensuring a comprehensive account of the care you received.

Electronic Medical Reimbursement Forms

While traditional forms still hold significant relevance, many healthcare providers now prefer electronic medical reimbursement forms. These digital formats streamline the claims process, reducing the time it takes for reimbursements to be processed and received.

Electronic medical reimbursement forms can enhance your experience by providing a faster, more efficient way to process your claims. They often integrate with practice management and billing systems, enabling automatic submissions and tracking of claims, which can significantly reduce the likelihood of errors and associated delays.

Specialty-Specific Reimbursement Forms

Forms designed for specific medical practices can expedite the process of specialty-specific reimbursement. These forms are customized to address unique aspects of certain specialties, ensuring that particular services, procedures, and coding requirements are met effectively.

Medical practitioners often use specialty-specific reimbursement forms to comply with the nuances of their field, such as varying coding rules and insurance requirements. By using these tailored forms, you can help ensure that your claims are complete and have a higher likelihood of swift approval, thus minimizing delays in receiving your reimbursements.

Perceiving the differences in these forms can vastly improve your understanding of the reimbursement process and enhance your interactions with healthcare providers and insurers.

Tips for Filling Out Medical Reimbursement Forms

Now that you are ready to tackle those medical reimbursement forms, it’s vital to follow certain tips to ensure you fill them out correctly and efficiently. Properly completing these forms can mean the difference between a smooth reimbursement process and unnecessary delays. Here are some key tips:

- Be thorough — Fill in all required fields.

- Be clear — Use legible handwriting or type your responses.

- Be accurate — Double-check your information.

- Understand policy coverage — Know what expenses are eligible for reimbursement.

- Meet deadlines — Submit your forms on time to avoid issues.

Thou shall ensure that you follow these tips for a successful reimbursement process!

Gather Necessary Documentation

On your way to filling out the medical reimbursement form, it’s crucial to gather all necessary documentation. This includes receipts for medical treatments, prescriptions, and any other relevant paperwork that demonstrates your expenses. Having these documents handy helps you accurately report the costs associated with your medical care and ensures that your claim is processed without hitches.

Double-Check Insurance Information

Tips for double-checking your insurance information include verifying that your policy number, group ID, and the insurance provider’s name are correctly listed. Accuracy in this section is crucial because errors can lead to delays or denial of your reimbursement claim. Make sure to check for potential typographical errors that could jeopardize your submission.

Forms submitted with incorrect or incomplete insurance information can lead to significant complications. Thoroughly compare the details on your claim to your insurance card and policy documents to ensure everything aligns. Not only does this prevent unnecessary follow-ups, but it also streamlines the processing time for your reimbursement request.

Keep Copies of Submitted Forms

Assuming you have submitted your forms, it’s a best practice to keep copies for your records. Retaining copies of your submitted forms can be invaluable in case you need to reference your submissions or need to follow up. This simple step can save you a lot of frustration, especially if questions arise about your reimbursement request.

Double-checking your copies against what you submitted can also help you track down discrepancies quickly. In the event that your claim is lost or requires re-submission, having these documents on hand ensures you can address issues without scrambling for original files.

Conclusively, effectively managing the medical reimbursement process can reduce stress and expedite your reimbursements. By following the tips shared in this article, you can improve your experience and get the financial support you deserve for your medical expenses.

Step-by-Step Guide to Submitting a Medical Reimbursement Form

Keep this guide handy as you navigate the process of submitting a medical reimbursement form. Properly following each step ensures that you receive your entitled reimbursements promptly. Below is a comprehensive breakdown of the process to streamline your efforts.

| Steps | Description |

|---|---|

| 1. Complete the Form Accurately | Fill in all required fields, double-checking for any errors to avoid delays. |

| 2. Attach Relevant Receipts and Bills | Include proof of payment, such as receipts or invoices, to support your claim. |

| 3. Submit via Mail or Electronically | Choose a submission method that works best for you, ensuring a clear record of your claim. |

Complete the Form Accurately

For your form to be processed without issues, it’s crucial that you complete it accurately. This means providing all personal information, expenses incurred, and any other data required by your insurance provider. Even minor errors can lead to delays or claim rejections, so take your time and verify each entry before moving on.

Attach Relevant Receipts and Bills

To support your claim effectively, you must attach all relevant receipts and bills. These documents serve as proof of your medical expenses and are vital for validation.

Bills should be clear and legible, showing the itemized charges of the services received. If you’re submitting multiple receipts, organize them logically to make it easier for the claims processor to review your submission. Scan and save your documents in high quality if submitting electronically to avoid any claims being disallowed due to illegibility.

Submit via Mail or Electronically

With technology at your fingertips, you have options when it comes to submitting your form. You can opt to mail your documentation or submit it electronically, depending on what is offered by your insurance provider.

This flexibility can significantly speed up your reimbursement process. If you choose electronic submission, ensure that you keep a digital copy as well as confirmation of your submission. This safeguards against any discrepancies that may arise later concerning the receipt of your claim.

Factors to Consider When Submitting Claims

Many factors can influence the success of your medical reimbursement claim. To ensure a smooth submission process, keep the following points in mind:

- Insurance Policy Coverage

- Claims Submission Deadlines

- Common Denial Reasons

- Receipt and Documentation

- Claim Appeal Process

After considering these factors, you can improve your chances of receiving a timely reimbursement.

Insurance Policy Coverage

Insurance coverage is crucial when submitting a medical reimbursement form. You should review your insurance policy to understand what services are covered, including any deductibles or co-pays. Familiarizing yourself with these details helps you avoid unexpected costs and enhances your chances of a successful claim.

Claims Submission Deadlines

Claims need to be submitted promptly to ensure they are processed in time. Understanding your insurer’s claims submission deadlines is imperative to receive your reimbursement without delays.

It is best practice to submit your claims as soon as possible after receiving medical services. Most insurance companies have specific deadlines—typically ranging from 30 to 180 days—within which you must file your claim. Missing these deadlines may lead to claim denial and loss of reimbursement. Ensure you track these timelines carefully.

Common Denial Reasons

Insurance companies may deny claims for several reasons, from insufficient documentation to policy exclusions. Being aware of common denial reasons can help you prevent issues when submitting your claim.

Deadlines, incomplete or incorrect information, and non-covered services are among the leading causes of claim denials. It’s crucial to double-check your submission for accuracy and completeness, as this can save you time and frustration in the long run. Understanding these factors will empower you to navigate the claims process effectively.

Medical Reimbursement Form: Pros and Cons

Not every approach to handling medical expenses is foolproof. Understanding the advantages and disadvantages of medical reimbursement forms will empower you to make informed decisions about your healthcare financing. Below, we have summarized the key pros and cons in a concise table format.

Pros and Cons of Medical Reimbursement Forms

| Pros | Cons |

|---|---|

| Streamlines expense tracking | Can be time-consuming for submissions |

| Potential tax benefits | Requires thorough documentation |

| Improved cash flow management | Limited to covered expenses |

| Encourages awareness of healthcare costs | Complexity of forms may lead to errors |

| Promotes healthier financial practices | Possibility of delayed reimbursements |

| Can be used alongside insurance | May involve additional fees from providers |

| Supports budget planning | Not universally accepted by all providers |

| Encourages preventative care | Customs regulations can complicate reimbursements |

| Enables employee benefits in workplaces | Involves understanding complex policies |

| Facilitates access to necessary treatments | Cumbersome appeal processes if denied |

Advantages of Using Reimbursement Forms

There’s no denying that using medical reimbursement forms can significantly enhance your ability to manage healthcare expenses. By streamlining your expense tracking and potentially providing tax benefits, these forms allow you to maintain better control over your financial health. This proactive approach can also help you stay informed about the costs associated with your healthcare, encouraging smarter decisions for future medical needs.

Disadvantages and Challenges

Any system comes with challenges, and medical reimbursement forms are no exception. While you might enjoy certain benefits, you also face a number of hurdles. The process can be time-consuming, often requiring extensive documentation and attention to detail to avoid errors. Additionally, you may encounter limitations on what is covered, which may lead to frustration if your out-of-pocket expenses do not align with your expectations.

A careful examination of the disadvantages can reveal significant pain points. For example, submitting reimbursements can be a tedious task, often involving complex forms and supporting documents. Delayed reimbursements are another prevalent issue, which can strain your finances if you rely heavily on quick access to funds. Additionally, the potential for errors during submission could result in your reimbursement being denied, prompting you to engage in cumbersome appeals that require even more time and effort. Thus, it’s crucial to weigh these challenges against the benefits to determine if medical reimbursement forms are the right choice for your situation.

To Wrap Up

As a reminder, understanding the medical reimbursement form is vital for ensuring you receive the financial support you deserve after incurring medical expenses. By accurately completing the form and providing all necessary documentation, you facilitate a smoother reimbursement process. Keep in mind the importance of double-checking your submissions to avoid delays. If you ever feel uncertain, don’t hesitate to reach out to your healthcare provider or insurance company for guidance. Being proactive in managing your medical expenses can significantly ease the financial burden on you and your family.

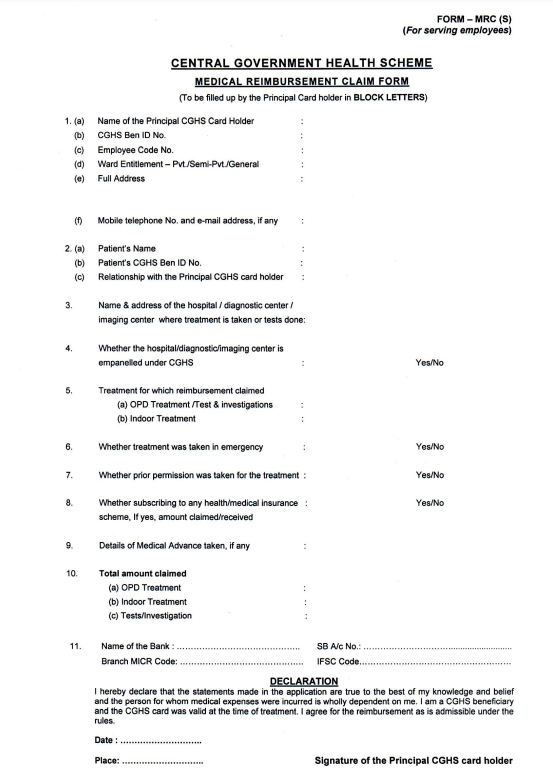

Download Medical Reimbursement Form

FAQ

Q: What is a Medical Reimbursement Form?

A: A Medical Reimbursement Form is a document used by employees to request reimbursement from their employer or insurance provider for medical expenses incurred. This form typically requires details such as the type of medical service received, the total amount paid, and supporting documents like receipts or invoices. It ensures that employees are reimbursed in accordance with their employer’s health benefits plan.

Q: How do I fill out a Medical Reimbursement Form?

A: To fill out a Medical Reimbursement Form, follow these steps:

1. Begin by entering your personal and employment information, including your name, employee ID, and contact details.

2. Specify the dates when the medical services were provided.

3. Provide a breakdown of the expenses by itemizing each service, including the cost associated with it.

4. Attach all relevant receipts and documents that substantiate your claim.

5. Review the completed form for accuracy and completeness before submitting it to the appropriate department for processing.

Q: How long does it take to process a Medical Reimbursement Form?

A: The processing time for a Medical Reimbursement Form can vary based on the employer’s policies and the volume of claims being handled. Generally, it can take anywhere from a few days to several weeks for a claim to be processed and for the reimbursement to be issued. It is advisable to check with your HR department or the finance office for specific timelines and any potential delays in processing claims.