Reimbursement can be a complex process, but understanding the Medicare Reimbursement Form is important for you to recover costs for eligible medical expenses. This guide will equip you with the knowledge needed to accurately fill out the form, ensuring you safeguard your financial interests and avoid potential pitfalls that could delay your claims. Whether you are submitting for yourself or on behalf of a loved one, navigating the Medicare reimbursement system doesn’t have to be overwhelming. Let’s look into the details that will make your filing experience smoother and more efficient!

Types of Medicare Reimbursement Forms

A comprehensive understanding of the different types of Medicare reimbursement forms is important for efficient processing of claims and ensuring that you receive the benefits you deserve. Each type of form serves a distinct purpose, so it’s crucial to familiarize yourself with them. Below is a breakdown of the various forms you may encounter:

| Form Type | Description |

| Standard Medicare Claim Form (CMS-1500) | The primary form for submitting claims for outpatient services. |

| Institutional Claim Form (UB-04) | Designed for facility-based services, including hospitals. |

| Medicare Advantage Claim Form | For submitting claims under Medicare Advantage plans. |

| Home Health Agency Claim Form | Utilized for claims related to home health services. |

| Durable Medical Equipment Claim Form | Specialized form for claims regarding medical equipment. |

This knowledge can empower you to navigate the reimbursement process more effectively.

Standard Medicare Claim Form

On the whole, the Standard Medicare Claim Form, known as CMS-1500, is the most commonly used document for providers who submit claims on behalf of their patients. This form covers various outpatient services and ensures that you can file for reimbursement promptly when receiving non-institutional healthcare. Knowing how to accurately fill out this form is important for expediting your claims.

Specialized Forms for Services

With specialized forms specifically designed for certain services, you can streamline your claim process further. These forms cater to particular healthcare needs, making the submission of claims more straightforward and efficient. You’ll find that each specialized form aids in meeting the requirements for certain types of care and treatment.

Plus, understanding the specific Specialized Forms for Services guarantees that you won’t face delays or denials in your claims. For example, the Home Health Agency Claim Form is vital for ensuring that your home health aide services are reimbursed correctly. Similarly, the Durable Medical Equipment Claim Form should be completed accurately to cover equipment needs. Missing or incorrect information on these forms can lead to significant setbacks, so attention to detail is crucial. Note, timely submission and correct form usage can greatly affect your healthcare reimbursements.

Step-by-Step Guide to Completing Medicare Reimbursement Forms

Even though the process of completing Medicare reimbursement forms may seem overwhelming, understanding the steps can simplify the task. Here’s a detailed guide to walk you through each stage effectively.

| Step | Description |

|---|---|

| 1. Gathering Necessary Information | Collect all relevant details, such as your Medicare number, provider information, dates of service, and any related receipts. |

| 2. Filling Out the Form Accurately | Ensure that you complete each section with precision, double-checking for errors that could lead to delays in processing. |

| 3. Submitting the Form | Send your completed form to the appropriate Medicare address, ensuring you use certified mail or a tracking service if possible. |

Gathering Necessary Information

Step by step, you need to gather all the necessary information before starting to fill out the Medicare reimbursement form. This includes your Medicare number, details about the services received, provider’s information, and any relevant invoices or receipts. Organizing this information ahead of time will streamline the process and ensure you don’t miss any important details.

Filling Out the Form Accurately

You must fill out the Medicare reimbursement form with utmost accuracy. Take your time to review each section, ensuring you enter your Medicare number correctly, list all services rendered, and provide the necessary signatures. Simple mistakes can lead to delays or denied claims, so avoid rushing through this critical step.

Another important aspect of this process is to refer to the Medicare guidelines while filling out the form. Descriptions must match the services you received, including the correct procedure codes. Additionally, including all relevant supporting documents, such as medical records or hospital statements, will further substantiate your claim and minimize the risk of denial.

Submitting the Form

If you’re ready to submit the form, make sure that it is addressed to the correct Medicare office. Verify that all fields are filled out completely and correctly. Sending the form via a secure method, such as certified mail, provides you with proof of delivery, which can be vital if your submission is questioned.

Form submission is the final step in the process, but it’s crucial to keep a copy of everything you send. Hold onto all documentation until you’ve received confirmation from Medicare regarding your claim. This may take time, so patience and attention to detail are key in ensuring your reimbursement is processed efficiently.

Important Factors to Consider

Unlike any other reimbursement processes, completing a Medicare reimbursement form requires careful attention to detail to ensure you’re paid accordingly. Here are some important factors to consider:

- Accurate patient information

- Correct coding and billing procedures

- Understanding of Medicare policies

- Timely submission of forms

- Awareness of potential audits

After taking these factors into account, you can navigate the reimbursement process more effectively and increase your chances of successful claims.

Eligibility Requirements

Clearly, you must meet specific eligibility requirements to qualify for Medicare reimbursement. Generally, you need to be a Medicare beneficiary, which may involve age-related qualifications or specific health conditions. Confirm your eligibility status before proceeding with the form, as this will shape your reimbursement journey.

Submission Deadlines

You must also be aware of the crucial submission deadlines for Medicare reimbursement forms. Timely submission is crucial, as delays can lead to denied claims or reduced payments. Missing a deadline may not only jeopardize your reimbursement but can also affect your future claims.

Factors that contribute to the importance of these deadlines include the strict limits placed on when you can submit a claim. Generally, you have 12 months from the date of service to submit your paperwork. Missing this window can lead to lost revenue and negatively impact your financial planning. Additionally, ensure all documentation is complete and accurate, as errors can delay processing further. Being proactive and organized is critical to a successful reimbursement process, so adhere to these deadlines to safeguard your interests.

Tips for Successful Reimbursement

Now that you understand the basics of the Medicare reimbursement form, it’s crucial to follow specific strategies to ensure a smooth reimbursement process. Here are some tips to help you succeed:

- Ensure all patient information is accurate and complete.

- Use the correct procedure codes and diagnoses.

- Double-check your billing practices to align with Medicare guidelines.

- Submit your form within the required timeframe to avoid delays.

- Keep copies of all submitted documents for your records.

Knowing these tips can significantly enhance your chances of receiving timely and accurate reimbursement.

Common Mistakes to Avoid

Some common mistakes to avoid include submitting incomplete forms, using outdated procedure codes, or failing to provide proper documentation. Additionally, overlooking patient eligibility can lead to immediate denials, so always verify that the services provided are covered under Medicare. Ensuring that you avoid these pitfalls will help facilitate a smoother reimbursement process.

Keeping Detailed Records

Little do many providers know that maintaining comprehensive records is a cornerstone of successful reimbursement. Documentation supports your claims and reduces the likelihood of audit complications. Records should include patient notes, service details, and all related billing information.

Reimbursement processes can be intricate, making keeping detailed records necessary for your success. You should consistently document each step of your services, including dates of service, any communication regarding the patient’s treatment, and responses from Medicare. This information not only helps in resolving discrepancies but can also be crucial in appealing denied claims. By maintaining meticulous records, you empower yourself to manage your claims effectively and navigate the reimbursement landscape with confidence.

Medicare Reimbursement Form

After exploring the ins and outs of the Medicare reimbursement process, it’s crucial to consider the pros and cons of utilizing reimbursement forms. This section will help you weigh the advantages against the disadvantages, allowing you to make an informed decision.

| Pros | Cons |

|---|---|

| Easy access to funds for medical services received. | Time-consuming process to fill out and submit forms. |

| Potential for higher reimbursement based on costs incurred. | Reimbursement rates may vary and not cover all expenses. |

| Encourages individuals to keep track of their medical expenses. | Strict submission deadlines may lead to missed claims. |

| Provides a way to recover costs not covered by insurance. | Claim denial could occur, requiring further appeals. |

| Utilizes a structured process for documenting healthcare spending. | Complexity of forms could lead to errors in submission. |

| Increased awareness of financial aspects of healthcare. | Potential for frustration if communication with Medicare is unclear. |

| Allows for flexibility in selecting healthcare providers. | May require extensive documentation for larger claims. |

| Supports the provision of necessary healthcare services. | Could take weeks, or even months, before reimbursement is received. |

Benefits of Using Reimbursement Forms

You can enjoy numerous benefits by utilizing Medicare reimbursement forms. They not only provide a systematic way to recoup your healthcare expenses but also encourage you to keep organized records of your medical costs. By maintaining detailed documentation, you can maximize your reimbursement potential, ultimately ensuring that you are financially protected against unexpected medical bills.

Potential Drawbacks and Challenges

Cons may arise when dealing with Medicare reimbursement forms. Understanding these challenges can prepare you for the process and help you mitigate potential issues.

To navigate the reimbursement process effectively, it’s necessary to be aware of the **complexity** of Medicare forms and the potential for **errors** during submission. Each claim requires specific documentation, and missing even one detail could result in **denial** of your claim. Additionally, while waiting for reimbursement, you might face cash flow challenges, particularly if the processing time spans **weeks or months**. Being proactive and thorough in your approach will help you manage these potential setbacks effectively.

Summing up

Upon reflecting on the importance of the Medicare reimbursement form, it becomes clear that understanding this process is necessary for ensuring you receive the benefits you deserve. By accurately completing the form and adhering to the guidelines, you can effectively navigate the often-complex landscape of Medicare reimbursement. Equipping yourself with knowledge about the requirements and timelines not only streamlines your claims but also enhances your confidence in managing your healthcare finances. Ultimately, being proactive in this area will empower you to make the most of your Medicare coverage.

Understanding the Medicare Reimbursement Form

Navigating the labyrinth of healthcare can be challenging, especially when it comes to understanding reimbursement processes. One key component of this is the Medicare reimbursement form. This article provides an in-depth look into this imperative document, guiding you on its purpose, completion, and submission.

What is the Medicare Reimbursement Form?

The Medicare reimbursement form, commonly referred to as the CMS-1500 form, is a standard claim form used by healthcare providers to bill Medicare for services rendered to beneficiaries. This form is crucial for ensuring that providers receive payment for their medical services, making it an imperative part of the Medicare system.

Why is the Medicare Reimbursement Form Important?

Filling out this form correctly is vital for the following reasons:

- Timely Payment: Proper submission ensures timely reimbursement from Medicare.

- Accurate Records: It helps maintain accurate medical records for both the provider and the patient.

- Benefit Verification: It can assist in verifying patient eligibility for Medicare benefits.

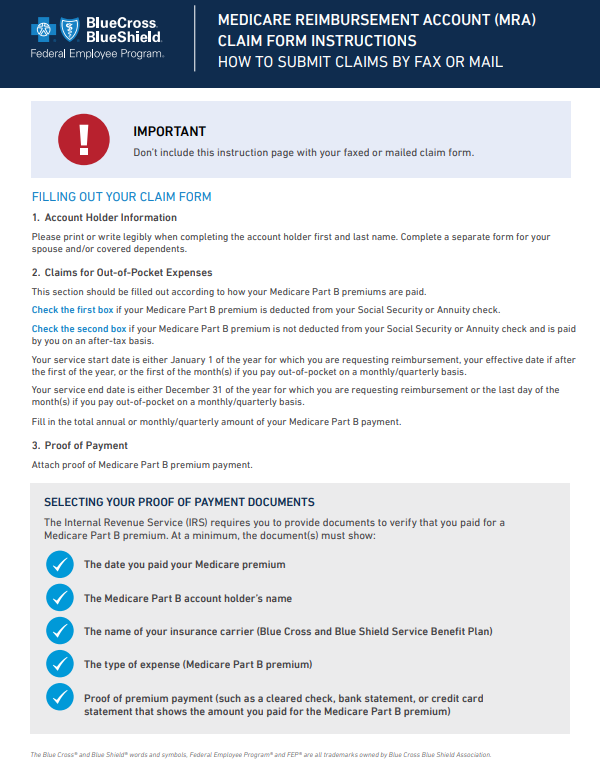

How to Complete the Medicare Reimbursement Form

Completing the form requires specific information, including patient details, insurance information, and the services provided. It’s important to follow the guidelines provided by Medicare to avoid delays in payment.

Download Medicare Reimbursement Form

FAQ

Q: What information do I need to complete the Medicare Reimbursement Form?

A: You will need the following information to accurately complete the form:

- Patient’s name, address, and Medicare number.

- Provider details, including name, address, and National Provider Identifier (NPI).

- Details of the medical service provided, including service dates, procedure codes (CPT/HCPCS), and associated charges.

- Insurance information if the patient has additional coverage.

Q: How do I submit the Medicare Reimbursement Form?

A: The Medicare reimbursement form can be submitted electronically or via mail. To submit electronically, you can use an electronic health record (EHR) system or a third-party billing service that accepts electronic submissions. If you choose to mail the form, print it out, complete all sections accurately, and send it to the designated Medicare Administrative Contractor (MAC) for your region. Make sure to keep a copy for your records.

Q: What should I do if my claim is denied?

A: If your claim is denied, don’t panic. First, review the denial notice to understand the reason for the denial. Common reasons might include errors in the form, lack of supporting documentation, or billing for non-covered services. You can then correct any mistakes and resubmit the claim or consider appealing the denial if you believe the service should be covered under Medicare policies. Ensure you follow the specific appeal process outlined in the denial notice.

Conclusion

The Medicare reimbursement form is imperative for facilitating healthcare claims, and understanding how to navigate it can mean the difference between timely payment and delays. By familiarizing yourself with the form, ensuring accuracy, and knowing how to handle denials, both healthcare providers and patients can enhance their experience within the Medicare system. Note, if in doubt, consult with a healthcare billing specialist for assistance.