As a Blue Cross Blue Shield (BCBS) member, **you’re entitled to reimbursement** for eligible medical expenses. However, navigating the reimbursement process can be overwhelming, especially when dealing with complex paperwork. Don’t let uncertainty hold you back from getting the compensation you deserve. In this guide, **we’ll walk you through the step-by-step process** of completing the BCBS reimbursement form, ensuring you receive fair reimbursement for your medical expenses. By the end of this article, **you’ll be confident and prepared** to submit your claim and get the reimbursement you’re owed.

Understanding Types of Reimbursement Forms

Before you start filling out a Blue Cross Blue Shield reimbursement form, it’s vital to understand the different types of forms that are available. This will ensure that you’re using the correct form for your specific needs and increasing the chances of a successful claim.

You’ll need to determine which type of reimbursement form applies to your situation, as each form is designed for a specific purpose. Here are some of the most common types of reimbursement forms:

- Medical Claims Forms: For medical expenses, including doctor visits, hospital stays, and surgical procedures.

- Prescription Claims Forms: For prescription medication expenses.

- Dental Claims Forms: For dental expenses, including routine cleanings, fillings, and oral surgery.

- Vision Claims Forms: For vision expenses, including eye exams, glasses, and contact lenses.

- Other Claims Forms: For miscellaneous expenses, such as medical equipment, home health care, and ambulance services.

The information can be broken down into the following table:

| Type of Form | Purpose |

| Medical Claims Forms | For medical expenses, including doctor visits, hospital stays, and surgical procedures. |

| Prescription Claims Forms | For prescription medication expenses. |

| Dental Claims Forms | For dental expenses, including routine cleanings, fillings, and oral surgery. |

| Vision Claims Forms | For vision expenses, including eye exams, glasses, and contact lenses. |

Medical Claims Forms

Claiming medical expenses is a crucial part of the reimbursement process. You’ll need to provide detailed information about your medical treatment, including dates, diagnoses, and treatment costs.

Prescription Claims Forms

While filing a prescription claim, you’ll need to provide information about your prescription medication, including the name of the medication, dosage, and duration of treatment.

For instance, if you’re taking a prescription medication for a chronic condition, you’ll need to provide documentation from your doctor explaining the necessity of the medication and the expected duration of treatment.

Dental Claims Forms

On the other hand, dental claims forms are used to reimburse you for dental expenses, including routine cleanings, fillings, and oral surgery.

The dental claims form will require you to provide detailed information about your dental treatment, including the type of procedure, date of service, and cost of treatment. Be sure to keep accurate records of your dental expenses, as this will help ensure a smooth reimbursement process.

Remember to carefully review each type of reimbursement form to ensure you’re using the correct one for your specific needs. By doing so, you’ll increase the chances of a successful claim and receive the reimbursement you deserve.

Tips for Filling Out the Reimbursement Form

Some common mistakes can delay or even reject your reimbursement claim. To avoid these issues, follow these tips to ensure a smooth and successful reimbursement process.

- Read and follow the instructions carefully to ensure you provide all required information.

- Double-check your math to avoid calculation errors.

- Keep a copy of your submitted form and supporting documents for your records.

Knowing these tips will help you fill out the reimbursement form accurately and efficiently, increasing your chances of a successful claim.

Accurate Patient Information

Clearly, enter your patient’s correct name, date of birth, and policy number to ensure the claim is processed correctly.

Detailed Description of Services

Reimbursement depends on a detailed description of the services you provided, including the date, time, and location of each service.

Services rendered should be described in detail, including the CPT/HCPCS codes and corresponding charges. This information will help Blue Cross Blue Shield determine the appropriate reimbursement amount.

Supporting Documentation

Services require supporting documentation, such as medical records and itemized bills, to validate the services provided.

It is important to attach all required supporting documents to your reimbursement form to avoid delays or rejections. Ensure that these documents are clear, legible, and complete to facilitate the reimbursement process.

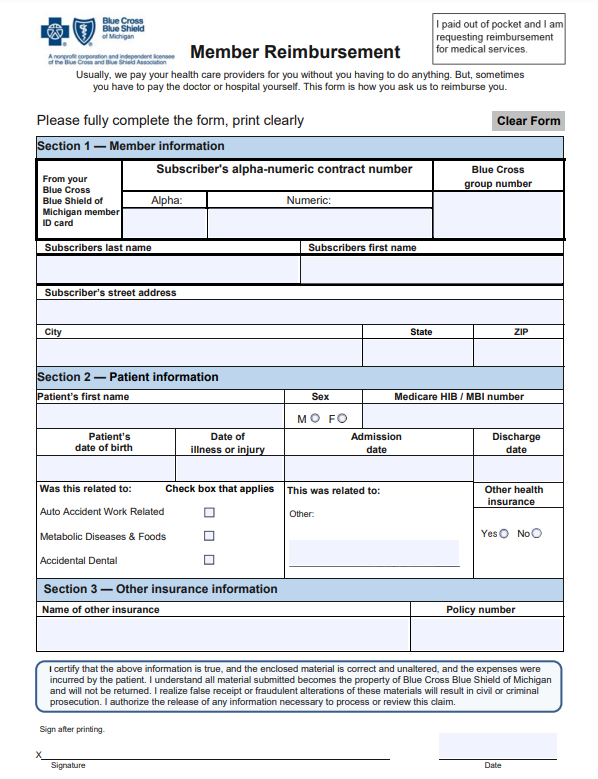

Step-by-Step Guide to Completing the Form

To ensure that your Blue Cross Blue Shield reimbursement form is processed accurately and efficiently, follow this step-by-step guide.

| Section | Description |

|---|---|

| Section 1: Patient Information | Provide patient demographics and insurance information |

| Section 2: Provider Information | Enter provider details and service information |

| Section 3: Claims Information | Report claim details, including dates and charges |

Section 1: Patient Information

Carefully enter your patient’s demographic information, including their name, date of birth, and insurance ID number. Make sure to provide accurate and up-to-date information to avoid delays in processing.

Section 2: Provider Information

If you are a provider, enter your practice information, including your name, address, and National Provider Identifier (NPI) number. This information is crucial for identifying you as the provider of service.

A crucial aspect of this section is ensuring that your NPI number is accurate and matches the one on file with Blue Cross Blue Shield. Any discrepancies can lead to delays or denials of your claim.

Section 3: Claims Information

Even if you’re familiar with the claims process, take your time to accurately report the claim details, including the dates of service, procedure codes, and charges. This information will be used to determine the amount of reimbursement you’re eligible for.

Section 3 requires attention to detail, as any errors or omissions can result in claim denials or reduced reimbursement. Double-check your entries to ensure accuracy and avoid unnecessary delays.

Factors Affecting Reimbursement

For a successful claim submission, it’s necessary to understand the factors that can impact your reimbursement. These factors can influence the amount you receive or even lead to claim denial.

- Policy coverage: The type of policy you have and the services covered under it.

- Claim submission timelines: The time frame in which you submit your claim.

- Medical necessity: The determination of whether the treatment or service was medically necessary.

- Provider network: Whether the healthcare provider is part of the Blue Cross Blue Shield network.

- Claim documentation: The accuracy and completeness of the claim form and supporting documents.

Recognizing these factors can help you navigate the reimbursement process more effectively.

Policy Coverage

With your Blue Cross Blue Shield policy, you need to ensure that the services you received are covered under your plan. Review your policy documents to understand what is covered and what is excluded.

Claim Submission Timelines

Some claims have specific submission timelines, and failing to meet these deadlines can result in delayed or denied reimbursement.

The claim submission timeline varies depending on the type of claim and the state you live in. For example, in some states, you may have up to one year to submit a claim, while in others, the deadline may be as short as 90 days. Make sure to check your policy documents or contact your insurer to determine the specific timeline for your claim.

Medical Necessity

Claim approval often hinges on the determination of medical necessity. This means that the treatment or service you received must be deemed necessary for your health and well-being.

Affecting this determination are factors such as the diagnosis, treatment plan, and medical records. Ensure that your healthcare provider accurately documents your medical history and treatment to increase the likelihood of claim approval.

Pros and Cons of Electronic vs. Paper Forms

Unlike traditional paper forms, electronic forms offer a more modern and efficient way to submit reimbursement claims to Blue Cross Blue Shield. However, it’s crucial to weigh the pros and cons of each option to determine which one best suits your needs.

| Electronic Forms | Paper Forms |

|---|---|

| Faster submission and processing times | More prone to errors and delays |

| Reduced paperwork and clutter | Physical storage space required |

| Easy access to claim status and history | Difficult to track claim status |

| Automatic calculations and validation | Manual calculations and validation required |

| Environmentally friendly | Contributes to paper waste |

| Enhanced security and data protection | Risk of lost or stolen documents |

| 24/7 accessibility | Limited access during business hours |

| Reduced administrative burden | Increased administrative tasks |

| Cost-effective | Incur additional printing and mailing costs |

Convenience and Efficiency

Electronically submitting your reimbursement form allows you to upload supporting documents and track the status of your claim in real-time, making the process more convenient and efficient for you.

Environmental Impact

The switch to electronic forms reduces your carbon footprint by minimizing paper waste and conserving natural resources.

Understanding the environmental impact of paper forms is crucial. According to the Environmental Protection Agency (EPA), the average American uses about 700 pounds of paper per year, with a significant portion of that being used for paperwork and documents. By choosing electronic forms, you’re contributing to a more sustainable future.

Security and Data Protection

The impact of a data breach or lost document can be devastating. Electronic forms offer enhanced security features, such as encryption and secure servers, to protect your sensitive information.

Another critical aspect of electronic forms is the reduced risk of identity theft and fraud. With paper forms, there’s a higher risk of documents being lost or stolen, which can lead to serious consequences. By submitting your reimbursement form electronically, you’re minimizing the risk of your personal information falling into the wrong hands.

Summing up

Ultimately, you’ve made it through the process of filling out the Blue Cross Blue Shield reimbursement form. You’ve gathered all the necessary documents, completed the required fields, and submitted your claim. By following these steps, you’ve taken the first step towards receiving reimbursement for your medical expenses. Remember to keep a copy of your submission for your records and follow up with BCBS if you have any questions or concerns about the status of your claim. With patience and persistence, you’ll be on your way to getting the reimbursement you deserve.

Download Blue Cross Blue Shield Reimbursement Form

Frequently Asked Questions about Blue Cross Blue Shield Reimbursement Form

What is the Blue Cross Blue Shield Reimbursement Form, and why do I need to fill it out?

The Blue Cross Blue Shield Reimbursement Form is a document required by Blue Cross Blue Shield (BCBS) insurance providers to process reimbursement claims for medical expenses incurred by their policyholders. You need to fill out this form to request reimbursement for eligible medical expenses that were not covered by your insurance plan or were paid out-of-pocket. The form helps BCBS to verify the authenticity of your claim and ensure that you receive the correct reimbursement amount. It’s imperative to fill out the form accurately and provide all required documentation to avoid delays or denials in the reimbursement process.

What information do I need to provide on the Blue Cross Blue Shield Reimbursement Form, and what supporting documents are required?

To complete the Blue Cross Blue Shield Reimbursement Form, you’ll need to provide personal and insurance information, including your name, policy number, and dates of service. You’ll also need to describe the medical services or treatments you received, including the diagnosis, procedure codes, and the amount you’re claiming for reimbursement. Supporting documents that may be required include:

- Itemized bills or receipts from healthcare providers

- Explanation of Benefits (EOB) statements from BCBS

- Prescription medication labels or packaging

- Medical records or documentation from healthcare providers

Make sure to attach all required documents to the form and keep a copy for your records. Incomplete or inaccurate submissions may result in delays or denials.

How do I submit the Blue Cross Blue Shield Reimbursement Form, and how long does it take to receive reimbursement?

You can submit the completed Blue Cross Blue Shield Reimbursement Form via mail, fax, or online portal, depending on your insurance provider’s instructions. Be sure to follow the submission guidelines carefully to avoid any issues. The processing time for reimbursement claims varies, but typically takes 2-4 weeks from the date of receipt. You can check the status of your claim online or by contacting BCBS customer service. Once your claim is approved, reimbursement will be mailed to you in the form of a check or direct deposit, depending on your preference.