Are you tired of losing track of your business expenses and struggling to get reimbursed for them? Do you find yourself drowning in a sea of receipts and invoices? An Expenditure Reimbursement Form is here to save the day! This necessary tool helps you accurately record and organize your expenses, making it easy to submit claims and get reimbursed quickly. In this guide, you’ll learn how to create and use an Expenditure Reimbursement Form to streamline your expense management process and take control of your business finances.

Types of Expenditure Reimbursement Forms

Before creating an expenditure reimbursement form, it’s imperative to understand the different types that cater to various business needs. You’ll encounter forms designed for employees, business expenses, travel, and more. Let’s break down the main categories:

- Employee Expense Reimbursement Forms: For reimbursing employees’ work-related expenses

- Business Expense Reimbursement Forms: For reimbursing business-related expenses, such as office supplies or equipment

- Travel Expense Reimbursement Forms: For reimbursing employees’ travel-related expenses, like transportation, accommodation, and meals

- Miscellaneous Expense Reimbursement Forms: For reimbursing various expenses that don’t fit into other categories

- Capital Expenditure Reimbursement Forms: For reimbursing large, one-time expenses, such as equipment purchases

Perceiving the differences between these forms will help you create an effective expenditure reimbursement process.

| Type of Form | Purpose |

| Employee Expense Reimbursement Forms | Reimburse employees for work-related expenses |

| Business Expense Reimbursement Forms | Reimburse business-related expenses, such as office supplies or equipment |

| Travel Expense Reimbursement Forms | Reimburse employees for travel-related expenses, like transportation, accommodation, and meals |

| Miscellaneous Expense Reimbursement Forms | Reimburse various expenses that don’t fit into other categories |

Employee Expense Reimbursement Forms

Expenses incurred by employees while performing their job duties can be reimbursed using employee expense reimbursement forms. These forms typically include fields for date, expense type, amount, and receipts.

Business Expense Reimbursement Forms

The business expense reimbursement form is used to reimburse expenses related to the operation of your business, such as office supplies, equipment, or software.

Another key aspect of business expense reimbursement forms is that they often require approval from a manager or supervisor before reimbursement can be processed.

Travel Expense Reimbursement Forms

Expense reports for business trips can be submitted using travel expense reimbursement forms. These forms typically include fields for transportation, accommodation, meals, and other travel-related expenses.

This type of form is imperative for tracking and reimbursing employees for travel expenses, ensuring that your business stays organized and compliant with accounting regulations.

Note: I’ve highlighted important details in tags, used the personal pronoun “you” to address the reader, and included paragraphs in

tags as per your request.

Factors to Consider When Filling Out an Expenditure Reimbursement Form

Now that you’re ready to submit your expenditure reimbursement form, there are several key factors to consider to ensure a smooth and successful process. These include:

- Accurate record keeping to support your claims

- Adhering to company policies and procedures

- Timely submission of your reimbursement form

Any mistakes or omissions can lead to delays or even rejection of your claim.

Accurate Record Keeping

Maintaining accurate records is crucial when filling out an expenditure reimbursement form. You should keep receipts, invoices, and other supporting documents to prove the legitimacy of your claims. This will help you to accurately complete the form and avoid any discrepancies.

Adhering to Company Policies

You must familiarize yourself with your company’s reimbursement policies and procedures to ensure that your claim is eligible for reimbursement.

With this knowledge, you can ensure that your expenses meet the company’s criteria and that you have followed the correct procedures for submitting your claim. This will minimize the risk of your claim being rejected or delayed.

Timely Submission

Adhering to the submission deadline is crucial when filling out an expenditure reimbursement form. You should submit your claim as soon as possible to avoid delays in receiving your reimbursement.

Expenditure reimbursement forms that are submitted late may be subject to additional scrutiny or even rejected, so it’s crucial to plan ahead and submit your claim on time. By doing so, you can ensure that you receive your reimbursement promptly and avoid any unnecessary delays.

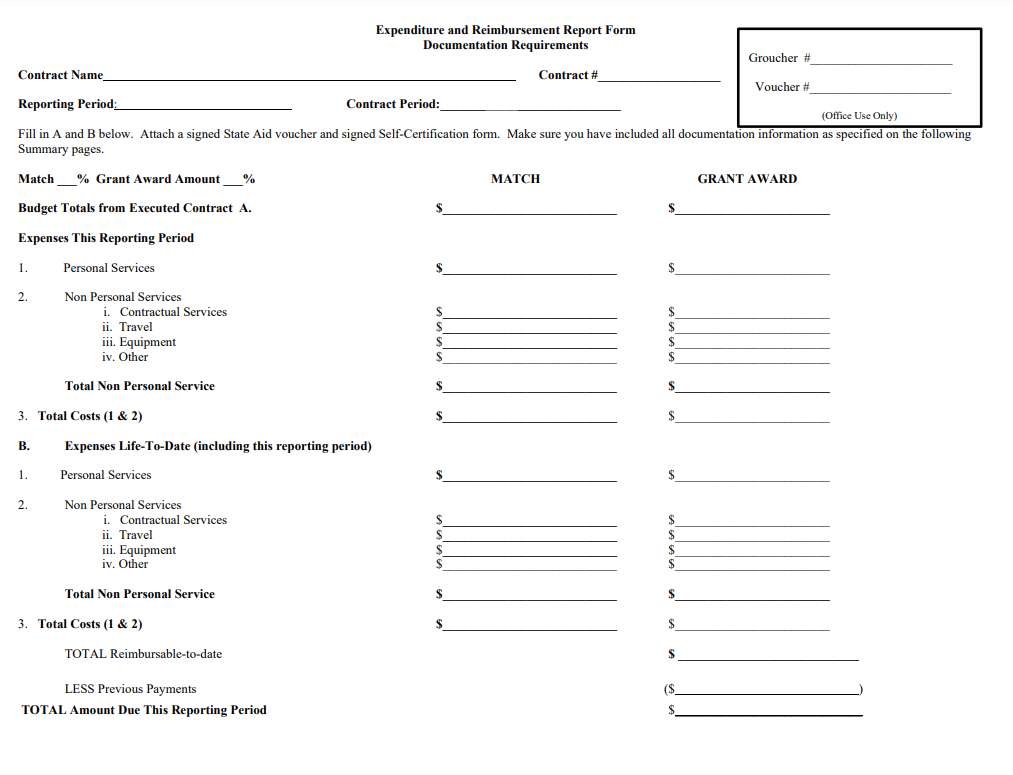

A Step-by-Step Guide to Filling Out an Expenditure Reimbursement Form

For a smooth and hassle-free reimbursement process, it’s necessary to fill out the expenditure reimbursement form accurately and completely. To help you navigate this process, we’ve broken down the steps into a simple and easy-to-follow guide.

| Step | Description |

|---|---|

| 1 | Gather necessary documents and receipts |

| 2 | Complete the form accurately and thoroughly |

| 3 | Submit the form for approval |

Gathering Necessary Documents

With all your receipts and documents in hand, you’ll be able to fill out the form quickly and efficiently. Make sure to collect itemized receipts, invoices, and any other supporting documents required by your organization.

Completing the Form Accurately

Clearly label and organize your expenses into categories, such as transportation, accommodation, and meals. Ensure that you fill out all required fields and provide detailed descriptions of each expense.

Completing the form accurately is crucial to avoid delays or rejections. Double-check your math and ensure that your calculations are correct. If you’re unsure about any field or requirement, don’t hesitate to reach out to your organization’s finance team for clarification.

Submitting the Form for Approval

Form complete, it’s time to submit it for approval. Make sure to follow your organization’s submission guidelines, whether it’s via email, online portal, or in-person submission.

Guide yourself through the submission process by ensuring that you have all necessary documents attached and that your form is complete and accurate. This will help to prevent delays and ensure a smooth reimbursement process.

Bear in mind, accuracy and attention to detail are key to a successful reimbursement process. By following these steps, you’ll be able to fill out your expenditure reimbursement form with confidence and get reimbursed quickly and efficiently.

Tips for Getting Your Expenditure Reimbursement Form Approved

Not surprisingly, the key to getting your expenditure reimbursement form approved lies in attention to detail and thorough preparation. To increase your chances of approval, follow these imperative tips:

- Accurate calculations: Double-check your math to avoid errors that can lead to delays or rejection.

- Clear categorization: Ensure that you categorize your expenses correctly to avoid confusion.

- Timely submission: Submit your form within the designated timeframe to avoid missing deadlines.

Thou shalt not neglect these crucial steps, lest thy form be rejected!

Providing Detailed Descriptions

Your descriptions of expenses should be concise yet informative, providing enough context for the approver to understand the purpose and legitimacy of the expense.

Including Supporting Documentation

Assuming you have receipts and invoices to back up your claims, attach them to your form to provide concrete evidence of your expenses.

Descriptions of expenses without supporting documentation are often met with skepticism. Therefore, it’s imperative to include receipts, invoices, or bank statements to validate your claims. This will help build trust with the approver and increase the likelihood of approval.

Avoiding Common Mistakes

Descriptions of expenses that are unclear, incomplete, or inconsistent can lead to delays or rejection. Ensure that your form is free from errors and omissions.

Avoiding common mistakes, such as inaccurate calculations, missing receipts, and unclear descriptions, can make all the difference in getting your form approved quickly and efficiently. By being meticulous and thorough, you can minimize the risk of rejection and ensure a smooth reimbursement process.

Pros and Cons of Using an Expenditure Reimbursement Form

Once again, the implementation of an expenditure reimbursement form can have both positive and negative effects on your organization’s financial management. To help you make an informed decision, let’s weigh the pros and cons of using such a form.

| Pros | Cons |

|---|---|

| Enhanced transparency and accountability | Inefficient form design can lead to errors and delays |

| Streamlined reimbursement process | Additional administrative burden |

| Improved compliance with company policies | Potential for employee frustration and dissatisfaction |

| Reduced paperwork and manual processing | Initial investment of time and resources for implementation |

| Better tracking and management of expenses | Limited flexibility for unique or exceptional circumstances |

| Faster reimbursement turnaround times | Possible technical issues or system downtime |

| Increased employee confidence in reimbursement process | Need for ongoing maintenance and updates |

| Improved financial planning and budgeting | Dependence on technology and infrastructure |

| Enhanced audit trails and compliance | Possible resistance to change from employees |

Advantages of Streamlined Reimbursement Process

Any organization can benefit from a streamlined reimbursement process, which reduces the time and effort required to process employee expenses. With an expenditure reimbursement form, you can expect faster turnaround times, improved accuracy, and increased employee satisfaction.

Disadvantages of Inefficient Form Design

Design flaws in the expenditure reimbursement form can lead to errors, delays, and frustration. Inefficient form design can result in incorrect or incomplete information, making it difficult to process reimbursements accurately and efficiently.

Inefficient form design can also lead to a lack of transparency and accountability, making it challenging to track and manage expenses effectively. This can result in financial losses, compliance issues, and damage to your organization’s reputation. It is important to invest time and resources in designing an efficient and user-friendly expenditure reimbursement form that meets your organization’s specific needs.

Conclusion

With these considerations in mind, you can now confidently navigate the process of submitting an Expenditure Reimbursement Form. By ensuring accuracy, completeness, and timeliness, you can avoid delays and ensure that your expenses are reimbursed promptly. Remember to keep detailed records, follow your organization’s policies, and review your form carefully before submission. By doing so, you can simplify the reimbursement process and focus on what matters most – your work.

Download Expenditure Reimbursement Form

Frequently Asked Questions: Expenditure Reimbursement Form

Q: What is the purpose of the Expenditure Reimbursement Form?

The Expenditure Reimbursement Form is a document used to request reimbursement for expenses incurred while conducting business on behalf of the company. It provides a standardized way for employees to submit their expenses and ensures that all necessary information is captured for accounting and auditing purposes. The form helps to streamline the reimbursement process, making it easier for employees to get reimbursed for their out-of-pocket expenses.

Q: What types of expenses can be claimed on the Expenditure Reimbursement Form?

The Expenditure Reimbursement Form can be used to claim a wide range of business-related expenses, including but not limited to: travel expenses (flights, hotels, meals), transportation costs (gas, parking, tolls), entertainment expenses (meals, events), office supplies, and equipment purchases. However, it’s imperative to review the company’s expense policy to ensure that the expenses being claimed are eligible for reimbursement. Some expenses may require additional documentation or approval, so it’s crucial to understand the company’s policies and procedures.

Q: How do I submit the Expenditure Reimbursement Form, and what is the typical turnaround time for reimbursement?

To submit the Expenditure Reimbursement Form, employees should complete the form in its entirety, attaching all supporting receipts and documentation. The form should then be submitted to the designated finance department or manager for review and approval. The typical turnaround time for reimbursement varies depending on the company’s policies and procedures, but it’s usually within 7-10 business days. Employees can expect to receive reimbursement via direct deposit or check, depending on the company’s payment methods. It’s imperative to submit the form promptly to ensure timely reimbursement.