Reimbursement can often be a daunting process, especially when it comes to medications like Mounjaro. This guide is designed to help you navigate the reimbursement form for this diabetes medication, ensuring that you can maximize your healthcare benefits. You’ll learn how to fill out the necessary paperwork, what documents are required, and how to avoid common pitfalls that could delay your reimbursement. By the end of this article, you’ll feel confident in submitting your Mounjaro reimbursement form and securing the benefits you deserve.

Mounjaro Reimbursement Form

Understanding Mounjaro

While navigating the world of medications can be challenging, understanding Mounjaro is crucial for those looking to manage their health effectively. This medication has gained attention for its efficacy in treating conditions such as type 2 diabetes. By leveraging innovative technology, it works to regulate blood sugar levels while also aiding in weight loss.

What is Mounjaro?

Some of the vital features of Mounjaro include its role as a GLP-1 receptor agonist. It mimics natural hormones in your body to help insulin secretion while minimizing glucose output from the liver. This dual action is particularly beneficial for managing blood sugar and supporting weight loss.

Types of Mounjaro Reimbursement Forms

The different reimbursement forms available for Mounjaro can affect your access and out-of-pocket costs. Understanding these options can help you navigate your insurance requirements more efficiently. Mounjaro reimbursement forms are designed to clarify the coverage provided by your insurance plan, ensuring you receive financial support for your medication.

| Type of Form | Description |

| Prior Authorization | Required approval from insurance before coverage begins. |

| Claims Form | Used to request repayment for out-of-pocket expenses. |

| Denial Appeal | Formal request for reconsideration of coverage denial. |

| Pharmacy Reimbursement | Specific to pharmacist-dispensed medications. |

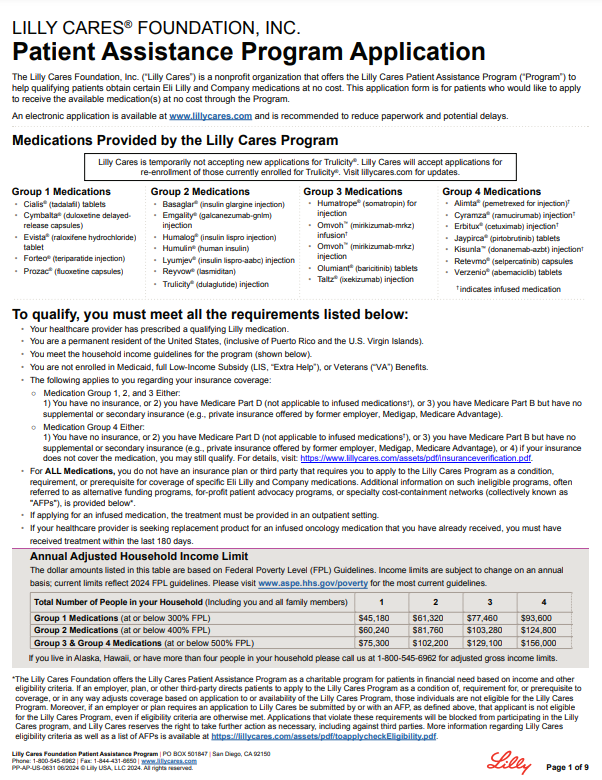

| Patient Assistance Program | Financial assistance options for eligible patients. |

For instance, understanding your plan’s specifics can position you to make better financial decisions regarding your Mounjaro treatment. Each form has its own set of requirements and processes that you must follow.

- Prior Authorization is often necessary to demonstrate medical necessity.

- A Claims Form is pivotal if you’ve paid out-of-pocket.

- Denial Appeals can significantly contribute to securing coverage.

- Pharmacy Reimbursement helps mitigate costs when picking up your medication.

- Consider the Patient Assistance Program if you struggle with expenses.

After understanding these forms, you’ll be better prepared to handle any potential requests or appeals regarding Mounjaro reimbursement. Keep in mind, clear communication with your healthcare provider and insurance company can help streamline the reimbursement process and ensure you receive the financial support you need.

Tips for Completing the Reimbursement Form

You want to ensure that your Mounjaro reimbursement form is completed accurately to avoid any delays in processing. Here are some helpful tips to guide you through the process:

- Ensure that all sections of the reimbursement form are filled out completely.

- Double-check your personal information for accuracy.

- Attach all required documentation, such as receipts and prescriptions.

- Keep copies of everything you submit for your records.

- Review the submission guidelines to confirm that you meet all criteria.

Knowing these tips will significantly increase your chances of a successful reimbursement claim.

Common Mistakes to Avoid

Now, avoiding common pitfalls can save you time and frustration. Many individuals forget to sign the form, submit incomplete documentation, or mislabel their attachments. These mistakes can lead to delays or even denials of your reimbursement request, so it’s crucial to take your time and carefully review your submission before sending it off.

Essential Details to Include

Essentially, you need to ensure that specific details are included in your submission. The Mounjaro reimbursement form should include your policy number, patient information, and details about the medication, including the prescription number and date filled.

For instance, when mentioning your policy number, make sure it matches exactly what is on your insurance card. Additionally, include any relevant supporting documents, like receipts, as these are critical for verifying your expenses. Don’t forget to list the dosage and treatment duration prescribed by your healthcare provider, as these details can help facilitate the reimbursement process.

Mounjaro Reimbursement Form

Little you may know, but submitting the Mounjaro reimbursement form can be a straightforward process if you follow the necessary steps carefully. Below, we’ve broken down the process into easy-to-follow segments.

StepDescription

| 1. Gather Your Information | Collect personal information, including your insurance details and any relevant prescriptions. |

| 2. Fill Out the Form | Complete the Mounjaro reimbursement form accurately, ensuring that all sections are filled out. |

| 3. Prepare Your Documentation | Organize any receipts, prescriptions, and insurance statements that support your claim. |

| 4. Submit Your Claim | Send the completed form and documents to the correct insurance address or email. |

| 5. Follow Up | Check in with your insurance provider to confirm the status of your claim. |

Preparing Your Documentation

Documentation is crucial when submitting your reimbursement form. To ensure your claim is processed smoothly, gather all necessary documents, such as copies of prescriptions, medical bills, and any communication you’ve had with your healthcare provider. Each item should be clearly labeled and organized, allowing for easy reference and validation of your claim. Proper documentation reduces the likelihood of delays and denials.

Submission Process and Follow-Up

Any oversight in the submission process can lead to complications or delays in your reimbursement. After you have filled out the form and attached your documentation, it’s imperative to submit it through the correct channels specified by your insurance provider.

Submission of your claim should be done promptly and tracked diligently. Ensure that you send your completed reimbursement form along with the necessary documentation via certified mail or through an insured email if available. After submission, keep a record of what you sent and when it was sent. Follow up with your insurance company after a few weeks to confirm receipt of your claim and inquire about the timeline for processing. Staying proactive can help you navigate any potential issues swiftly and keep you informed about your reimbursement status.

Mounjaro Reimbursement Form: Factors to Consider for Reimbursement

Your journey towards obtaining reimbursement for Mounjaro involves several important factors that could influence the outcome. Proper preparation is vital, ensuring all necessary documentation is ready and that you understand your insurance plan. Here are some key elements to keep in mind:

- Insurance Coverage Specifications

- Eligibility Criteria

- Documentation Requirements

- Appeals Process

- Out-of-Pocket Costs

Insurance Coverage Specifications

While different insurance providers have various policies, it is critical to verify whether your specific plan covers Mounjaro. Many plans may have limitations based on treatment history or may require prior authorization. Checking your policy can save you time and frustration later.

Eligibility Criteria

While knowing the eligibility criteria for Mounjaro is vital in receiving coverage, it’s equally important to consult your healthcare provider. They can assist in determining if you meet medical necessity guidelines that insurance companies often require. If Mounjaro is deemed appropriate for your condition, it can significantly enhance your chances of approval.

Reimbursement for Mounjaro typically hinges on clear documentation and medical justification. You must provide details such as diagnosis codes, treatment history, and prescribed dosage. Failure to meet these stringent eligibility criteria may lead to delayed or denied claims. Thus, ensure all information is accurately submitted to facilitate a smoother reimbursement process. Recognizing the importance of these factors can make a significant difference in your experience with the Mounjaro reimbursement process.

Mounjaro Reimbursement Form

Not everyone may be aware of the intricacies involved with Mounjaro reimbursement. Understanding the pros and cons of seeking reimbursement can help you make more informed decisions regarding your treatment. Here’s a detailed breakdown:

| Pros | Cons |

|---|---|

| Can significantly reduce out-of-pocket expenses | May involve complex paperwork and claims processing |

| Increases access to necessary medications | Potentially lengthy approval timelines |

| Encourages regular consultations with healthcare providers | Limitations on covered providers and pharmacies |

| Possibility of receiving coverage for additional treatments | Not all insurance plans cover Mounjaro |

| Can help track medication use for health records | Claim denials may require appeals, adding stress |

| May encourage adherence to medication schedule | Privacy concerns regarding medical records and claims |

| Potential for financial assistance programs | Variability in coverage based on state regulations |

| Improves overall health outcomes with access to treatment | High rejection rates for first-time claims |

| Builds an understanding of your insurance coverage | May require you to consult an insurance expert |

| Fosters a sense of financial security | Potential for higher premium costs after claims |

Advantages of Getting Reimbursed

Assuming you successfully navigate the reimbursement process for Mounjaro, you unlock numerous financial benefits that can greatly alleviate the burden of medication costs. It not only allows for more affordable access to imperative treatment but also encourages you to maintain regular healthcare consultations. Overall, it can enhance your overall health outcomes, making it a worthwhile endeavor.

Disadvantages and Challenges

Even with the enticing benefits, there are significant challenges you may encounter when seeking reimbursement for Mounjaro. The complexity of paperwork, varying state regulations, and the potential for claim denials can lead to frustration. Understanding these factors is key to managing your expectations and giving you insight into the path forward.

Understanding the difficulties you might face is crucial in navigating Mounjaro reimbursement effectively. If you encounter a denied claim, you may need to undertake an appeals process, which can be time-consuming and stressful. Additionally, inadequate knowledge about your coverage options can complicate matters further. It’s vital to stay informed about your plan’s specifics and to consider consulting with an insurance expert to ensure you’re maximizing your benefits while avoiding potential pitfalls.

Conclusion

On the whole, understanding and completing the Mounjaro reimbursement form is crucial for you to access the financial support you need for your treatment. By following the specific instructions and ensuring all necessary documentation is included, you streamline the process, enhancing the likelihood of a timely reimbursement. Stay informed about any updates or changes to the form to maximize your benefits. Your health and financial peace of mind are important, so take the time to complete this form accurately and thoroughly for optimal results.

Download Mounjaro Reimbursement Form

Mounjaro Reimbursement Form: Everything You Need to Know

Mounjaro (tirzepatide) has gained traction as an innovative treatment for type 2 diabetes and weight management. However, navigating the intricacies of healthcare reimbursements can be challenging. Understanding how to fill out the Mounjaro Reimbursement Form is vital for patients to secure coverage for this medication. This article will demystify the process and provide guidance for successful submissions.

What is the Mounjaro Reimbursement Form?

The Mounjaro Reimbursement Form is a document that patients or healthcare providers can submit to insurance companies or Medicare/Medicaid to request reimbursement for the cost of the Mounjaro medication. The form helps verify the patient’s eligibility for coverage, ensures the proper documentation is submitted, and facilitates the approval process for reimbursement claims.

Key Elements of the Mounjaro Reimbursement Form

- Patient Information: Basic details such as name, date of birth, and contact information.

- Insurance Details: Information about the patient’s health insurance plan, including policy number and group number.

- Provider Information: Name and contact information for the healthcare provider prescribing Mounjaro.

- Medication Details: Dosage prescribed, frequency, and duration of treatment.

- Supporting Documentation: Any required medical records, prescriptions, or previous treatment histories supporting the need for Mounjaro.

Now that we have an overview of the Mounjaro Reimbursement Form, let’s look into some frequently asked questions.

FAQ

Q: How do I obtain the Mounjaro Reimbursement Form?

A: You can typically download the Mounjaro Reimbursement Form from the official website of the drug manufacturer, Eli Lilly, or from your healthcare provider’s office. It’s important to ensure that you are using the most current version of the form for your submission. If you have trouble finding the form online, you can also contact the manufacturer’s customer service for assistance in obtaining it.

Q: What supporting documents should I include with the Mounjaro Reimbursement Form?

A: When submitting the Mounjaro Reimbursement Form, it is important to include relevant supporting documents to substantiate your claim. This may include a copy of your prescription, laboratory results, a letter of medical necessity from your healthcare provider, and any previous therapy documentation that outlines the need for Mounjaro. Some insurance companies may have specific requirements, so always check their instructions or contact them directly for guidance.

Q: What should I do if my reimbursement claim for Mounjaro is denied?

A: If your claim for Mounjaro reimbursement is denied, it is crucial to first review the explanation provided by your insurance company for the denial. Common reasons might include lack of medical necessity or incomplete documentation. You can then address the specific issues raised by gathering additional information or documentation. Many insurance companies allow patients to appeal a denial; follow their specific procedures for appeals, and consider obtaining support from your healthcare provider in providing additional medical justification for the use of Mounjaro.

Hence, navigating the reimbursement landscape for Mounjaro can be complex, but understanding the Mounjaro Reimbursement Form and the necessary steps can facilitate this process. Always consult with your healthcare provider and stay informed about your insurance coverage to maximize your chances of successful reimbursement.