Reimbursement forms are vital for recovering costs incurred during business activities. Understanding the proper reimbursement form format is critical for ensuring that your submissions are accepted without delay. A well-structured form not only speeds up the approval process but also minimizes the risk of rejection due to incorrect information. In this guide, you will learn the key components that should be included in your reimbursement forms, how to present your receipts effectively, and the best practices to follow for a smooth reimbursement experience.

Understanding Reimbursement Forms

Your journey into the world of reimbursement forms begins with understanding what they are and how they function within various financial frameworks. Reimbursement forms are crucial tools for documenting expenses, enabling organizations to efficiently process claims for incurred expenses by employees or clients. They ensure that your expenditures are tracked accurately and that you receive the funds you need to cover your costs.

Types of Reimbursement Forms

Your experience with reimbursement forms may vary depending on the context and company policies. There are several formats to be aware of:

- Expense Report – Details various incurred costs

- Travel Reimbursement Form – Specifically for travel-related expenses

- Medical Reimbursement Form – For health-related expenses

- Petty Cash Reimbursement – For small, everyday costs

- Purchase Requisition – For requesting reimbursement for purchased items

Thou can choose a form best suited for your needs based on the type of expenses you’re claiming.

| Type of Form | Description |

| Expense Report | General claims for work-related costs |

| Travel Reimbursement Form | Specifically for travel expenses like transportation and lodging |

| Medical Reimbursement Form | Claims related to medical or health expenses |

| Petty Cash Reimbursement | Used for small expenses requiring quick reimbursements |

| Purchase Requisition | For reimbursement when purchasing on behalf of the company |

Common Uses for Reimbursement Forms

An effective understanding of reimbursement forms includes recognizing their various applications. Typically, they are utilized across different industries whenever an employee incurs or anticipates incurring expenses during work-related tasks.

Understanding the common uses for reimbursement forms also provides insights into their practical importance. Employers often use these forms for travel expenses, office supply purchases, and even professional development costs. These forms streamline the reimbursement process by offering a systematic way to document and process claims, ensuring that you are paid back promptly and that financial records remain transparent. This system reduces errors and fraud, fostering trust between employers and employees. You benefit not only from a reimbursement but also from adhering to a structured organizational process.

Step-by-Step Guide to Filling Out a Reimbursement Form

Even in the most straightforward reimbursement processes, it’s crucial to approach each step methodically to ensure a smooth experience. Here’s a structured guide to help you fill out your reimbursement form correctly.

Steps to Complete Your Reimbursement Form

| Step | Description |

|---|---|

| 1. Preparing Required Documentation | Gather all necessary receipts, invoices, and other related documents to support your request. |

| 2. Completing the Form Accurately | Carefully fill out each section of the reimbursement form, ensuring all information is correct. |

| 3. Submitting the Form | Submit the completed form along with your documentation to the appropriate department or person. |

| 4. Following Up | Check-in on the status of your reimbursement to ensure it is being processed. |

Preparing Required Documentation

Documentation plays a vital role in the reimbursement process. You must collect and organize all relevant paperwork, including receipts, proof of payment, and any additional reports that justify your expense. Be sure these documents are clear and readable, as they are important for validating your request.

Completing the Form Accurately

While it may seem straightforward, taking the time to fill out your reimbursement form accurately can save you significant hassle later. Double-check all entries, ensuring every figure and detail corresponds with your supporting documents.

To enhance accuracy, pay special attention to **dates, amounts, and specific categories** on the form. Any discrepancies can lead to delays or even rejection of your claim, which could affect your ability to recoup funds promptly. **Always refer back to your gathered documentation** to ensure alignment. Lastly, consider keeping copies of everything submitted as a personal record. This practice will protect you should any issues arise during the reimbursement review process.

Essential Tips for Submitting a Reimbursement Form

Little details can make a significant difference when submitting your reimbursement form. To ensure a smooth process, consider these imperative tips:

- Always complete your form accurately and thoroughly.

- Submit your form as soon as possible to avoid delays.

- Attach all required receipts and documentation.

- Use clear and concise language when explaining expenses.

- Know your company’s reimbursement policies.

Perceiving these tips can lead to a more efficient reimbursement experience.

Double-Check Your Information

Even a small error on your reimbursement form can lead to significant delays in processing. Before you submit your form, take a moment to double-check all the details, including dates, amounts, and descriptions. This diligence ensures that you won’t face unnecessary complications when trying to receive your funds.

Keep Copies of All Submitted Documents

Any time you submit a reimbursement form, it is critical that you keep copies of all documents for your records. This includes the completed reimbursement form, attached receipts, and any correspondence with your employer or finance department. Keeping these copies provides you with a safety net in case of disputes or questions about your submission.

It is vital to maintain a well-organized record of your reimbursement submissions. Having these copies safeguards against potential errors and allows you to quickly reference previous claims if needed. If an issue arises, you’ll be equipped with proof of what you submitted and can address any concerns promptly. This proactive approach can also enhance your credibility and facilitate faster resolutions, making the reimbursement process more efficient.

Factors to Consider When Choosing a Reimbursement Form

Once again, it’s crucial to recognize that the choice of a reimbursement form can significantly impact the efficiency and accuracy of your expense management process. When you’re tasked with selecting the right format, consider the following factors:

- Organization Policies

- Types of Expenses

- Compliance Requirements

- User-Friendliness

- Submission Process

Assume that each of these aspects will directly influence how easily employees can navigate the reimbursement process and how quickly you can process claims.

Organization Policies and Requirements

Clearly, your organization’s policies play a pivotal role in selecting the appropriate reimbursement form. Different organizations have varying regulations concerning expense claims, and your form must align with these guidelines to ensure compliance and approval in a timely manner.

Types of Expenses Being Reimbursed

When identifying the right reimbursement form, it’s crucial to consider the types of expenses that will be covered. Here are some critical expense categories you should contemplate:

- Travel Expenses

- Office Supplies

- Meal Costs

- Training Costs

- Other Business Expenses

Perceiving the different types of expenses that your organization will reimburse will help streamline your form’s structure and functionality. Below is a table detailing common expense categories and their corresponding requirements:

| Expense Category | Requirements |

|---|---|

| Travel Expenses | Destination, purpose, and receipts required |

| Office Supplies | Itemized list and copies of receipts |

| Meal Costs | Per diem limits and attendee details |

| Training Costs | Course details and completion proof |

| Other Business Expenses | Detailed descriptions and receipts |

If you are thoroughly considering the types of expenses that will be included in your reimbursement form, it’s important to keep all potential scenarios in mind. This ensures that both you and your employees are clear about expectations and the documentation needed. Here are some more factors that can influence your choice:

- Approval Workflows

- Digital vs. Paper Forms

- Tracking Mechanisms

- Reporting Capabilities

- Feedback from Users

Perceiving the entire process and focusing on these additional considerations will lead you to a form that not only fulfills the requirements but also enhances the overall reimbursement experience for your team.

Pros and Cons of Different Reimbursement Form Formats

Not all reimbursement form formats are created equal, and choosing the right one can significantly impact your workflow. Understanding the advantages and disadvantages of each format will help you make an informed choice. Below is a breakdown of various reimbursement form formats to consider:

| Pros | Cons |

|---|---|

| Easy to understand and fill out | May lack necessary details for complex claims |

| Quick processing time | Limited space for explanations |

| Improves team collaboration | Could lead to increased errors |

| Environmentally friendly | May require technical skills for digital forms |

| Can be standardized across departments | Digital formats may experience compatibility issues |

| Enhanced tracking and record-keeping | Potential for cybersecurity risks |

| Supports real-time updates | May require software investments |

| Accessible from multiple devices | Technical glitches can disrupt the process |

| Facilitates remote work | Some users prefer traditional methods |

| Streamlined communication with finance teams | Resistance to change from staff |

Digital vs. Paper Forms

Any format you choose—digital or paper—affects the efficiency of your reimbursement processes. Digital forms can streamline submissions and enhance data handling through integrated systems. Conversely, paper forms may be more user-friendly for individuals uncomfortable with technology but can slow down processing times. Your choice should depend on the technological proficiency of your team and the speed with which you need to address claims.

Simplistic vs. Detailed Formats

Pros of using simplistic formats include faster completion and easier understanding, but they often come at the cost of detail. In contrast, detailed formats provide comprehensive information, allowing for proper assessment of claims, though they can be time-consuming and cumbersome to fill out.

A simplistic reimbursement form can foster quick submissions and efficiency, making it appealing for straightforward reimbursement scenarios. However, if you frequently deal with complex claims, incorporating detailed sections may be vital to avoid processing delays. Using a more detailed format can result in a wealth of information being captured, which assists finance teams in making informed decisions. But beware; overly complex formats can confuse submitters, leading to increased errors and delays. Balance is key: aim for a format that provides necessary details without overwhelming users.

Conclusion

On the whole, understanding the reimbursement form format is imperative for ensuring a smooth and efficient process for both you and your organization. By adhering to the required structure and providing all necessary information, you can help expedite approvals and minimize delays in receiving your funds. Always double-check that your forms are complete and accurate, as this can save you time and frustration. By following these guidelines, you enhance your chances of a successful reimbursement experience.

Reimbursement Form Format: A Comprehensive Guide

In the context of navigating company policies regarding expenses, understanding the reimbursement form format is crucial for both employees and employers. A reimbursement form allows employees to claim back money spent on behalf of the company, ensuring that they are compensated for out-of-pocket expenses incurred while performing their job. Below, we provide a comprehensive overview of the typical components of a reimbursement form, as well as tips for filling it out effectively.

Understanding the Components of a Reimbursement Form

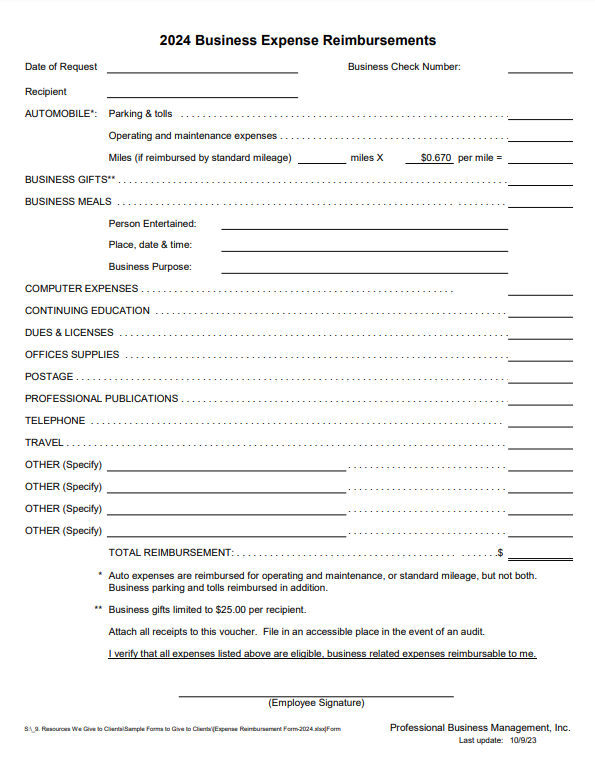

A standard reimbursement form generally includes several key sections:

1. Employee Information: This includes fields for the employee’s name, department, contact information, and employee ID.

2. Expense Details: A breakdown of expenses should be categorized as clearly as possible. This usually includes:

- – Date of the expense

- – Description of the expense (e.g., meals, travel, supplies)

- – Total amount claimed

- – Receipts or attached documentation to validate the expenses

3. Approval Signatures: Often, a line for the supervisor’s or manager’s approval is required, as this ensures that the claimed expenses are validated and in accordance with company policy.

4. Overall Totals: A final section that summarizes the total amount being claimed for reimbursement.

Best Practices for Filling Out a Reimbursement Form

To ensure a smooth reimbursement process, employees should follow these best practices:

- Be Thorough: Include all required documents and details. Missing receipts or incomplete forms can delay the approval process.

- Check Policies: Familiarize yourself with your company’s expense policy to identify which expenses are eligible for reimbursement.

- Review Before Submission: Double-check all entries to prevent any errors that could lead to confusion or rejection of the claim.

Now, let’s address some frequently asked questions regarding the reimbursement form format.

Download Reimbursement Form Format

FAQ

Q: What documents do I need to attach to my reimbursement form?

A: Typically, you need to attach original receipts for all expenses being claimed. If receipts are misplaced, some companies might allow alternative documentation like credit card statements or a signed declaration. Always check your company’s specific policy to ensure compliance.

Q: How long does it take for my reimbursement to be processed?

A: The time frame for processing reimbursement forms can vary widely depending on the company’s payroll and accounting procedures. Generally, it can take anywhere from a few days to several weeks. It’s best to inquire with your HR or finance department for timelines specific to your organization.

Q: Can I submit a reimbursement claim for expenses incurred before joining the company?

A: No, usually only expenses incurred after your official start date can be reimbursed. However, certain exceptions may apply for costs directly related to onboarding processes or pre-employment activities. Always refer to your company’s reimbursement policy or check with HR for clarification.

Conclusion

Understanding the reimbursement form format is imperative for efficient expense management in the workplace. By following the correct guidelines and procedures, employees can ensure that their claims are processed promptly. Remember to keep up to date with your company’s reimbursement policies, as they can change and may affect your submissions. By taking these steps, both employees and employers can foster a smoother reimbursement process, promoting transparency and trust in financial dealings.