Many businesses and employees face challenges when it comes to managing expense reimbursements. Utilizing a well-structured reimbursement form template can streamline the process, making it easier for you to submit your expenses and for your organization to track them. This guide will equip you with the necessary tools and tips to create an effective template that ensures accuracy and compliance, ultimately enhancing the reimbursement experience and minimizing potential discrepancies. Whether you’re handling small expenses or large claims, having the right template is crucial for maintaining a smooth flow of financial transactions.

Types of Reimbursement Forms

To effectively manage various expenses, it’s important to understand the different types of reimbursement forms. Each form serves a specific purpose and caters to distinct types of expenditures you may encounter. Here’s a breakdown:

| Type of Reimbursement Form | Description |

|---|---|

| Medical Reimbursement Forms | Used for claiming health-related expenses. |

| Travel Expense Reimbursement Forms | Intended for costs incurred during business travel. |

| Business Expense Reimbursement Forms | For expenses related to business operations. |

| Employee Reimbursement Forms | General form for employee-incurred costs. |

| Petty Cash Reimbursement Forms | Used for minor and miscellaneous expenses. |

After understanding the types, you can choose the appropriate form for your needs.

Medical Reimbursement Forms

Medical Reimbursement Forms are important for you to effectively claim medical expenses incurred during treatment or preventive care. These forms ensure you receive reimbursements for consultations, medications, and procedures. Always keep copies of your medical invoices and receipts handy for smooth processing.

Travel Expense Reimbursement Forms

With Travel Expense Reimbursement Forms, you can easily track expenses related to your work travels. These forms cover items like airfare, accommodation, meals, and transportation.

A well-prepared Travel Expense Reimbursement Form streamlines your claims, making it easier for you to receive timely reimbursements. Ensure all receipts are attached and adhere to your company’s travel policy to avoid any issues.

Business Expense Reimbursement Forms

Business Expense Reimbursement Forms are vital for tracking and reimbursing costs associated with business operations. Whether it’s supplies, client meals, or office utilities, these forms help you maintain clear financial records.

For instance, if you purchase office supplies or attend a client lunch, filling out a Business Expense Reimbursement Form allows you to reclaim those costs effectively. Always outline the purpose of the expenditures for easier approval from your finance department.

Tips for Completing Reimbursement Forms

There’s no doubt that filling out a reimbursement form can seem daunting. However, with the right tips, you can simplify the process and ensure you’ll receive your funds without unnecessary delays. Here are some important tips to consider:

- Read the instructions carefully to understand what is required.

- Ensure all information is accurate and matches your supporting documents.

- Keep a copy of your form for your records.

- Double-check the submission deadlines.

- Include all necessary supporting documentation.

Recognizing these key tips will help you navigate the reimbursement process more efficiently.

Ensuring Accuracy and Completeness

There’s nothing more frustrating than having your reimbursement form rejected due to simple errors. Make sure your entries are complete, including your name, address, and the exact amounts. Double-check for any typos or miscalculations before submission.

Common Mistakes to Avoid

An effective strategy for completing your reimbursement form is to be aware of common mistakes. Failing to include necessary details, like the purpose of expenses or incorrect dates, can lead to delays or denials.

It’s crucial to ensure that you have completed every section of the form to avoid any setbacks. Incomplete forms, missed signatures, and using outdated templates are just a few examples of pitfalls that can hinder your reimbursement process. Awareness of these common errors will empower you to submit a flawless application.

Supporting Documentation

Assuming you can skip including supporting documentation is a common misstep. Always attach receipts, invoices, or any other required proof of payment to bolster your claims.

Plus, providing comprehensive and well-organized supporting documentation not only increases your chances of approval but streamlines the review process. It’s important that these documents clearly outline the nature of your expenses and correspond directly with the amounts claimed on your form. This way, you minimize the risk of discrepancies and ensure a smoother reimbursement experience.

Step-by-Step Guide to Filling Out Reimbursement Forms

For anyone looking to navigate the reimbursement process effectively, following a structured approach is crucial. This guide breaks down the steps to ensure you complete your reimbursement form accurately and efficiently. Below is a concise overview of what to consider at each stage.

| Step | Description |

|---|---|

| 1. Gathering Necessary Information | Collect all relevant documents and details required for the reimbursement. |

| 2. Filling Out the Form | Carefully input all required information into the reimbursement form. |

| 3. Submitting the Form | Ensure proper submission and follow-up on the reimbursement request. |

Gathering Necessary Information

Even before you sit down to fill out the reimbursement form, it’s crucial to gather all necessary documentation. This includes receipts, invoices, and any relevant details about the expenses incurred. Having everything ready simplifies the process and reduces the likelihood of errors.

Filling Out the Form

Even the most straightforward forms can be tricky if you’re not careful. It’s crucial to review each section of the form thoroughly to ensure you include all required information. Pay close attention to details such as the amounts, dates, and the purpose of each expense.

Understanding the form’s structure will benefit you immensely. Be meticulous while filling out sections, and double-check your entries. Make sure to use accurate figures and descriptions, and follow any specific guidelines provided by your organization. Bear in mind, incorrect or incomplete submissions can lead to delays or denials of your reimbursement request.

Submitting the Form

Guide yourself through the submission process by confirming all information is complete and accurate before you send it off. Follow your organization’s preferred submission method, whether it’s through an online portal, email, or physical mail.

Filling out the reimbursement form is only part of the process; proper submission is critical to receive your funds timely. After submitting, it’s wise to follow up based on the guidelines provided to ensure your request is being processed. Keep copies of your submitted forms and any correspondence in case you need to reference them later.

Factors to Consider When Using Reimbursement Forms

Not all reimbursement forms are created equal, and there are several factors you need to keep in mind for effective results. Ignoring these can lead to delays in processing or even denials of your claims. Here are some critical elements to consider:

- Employer Policies

- Tax Implications

- Timeliness of Submission

Any of these factors can significantly affect your experience when submitting reimbursement claims.

Employer Policies

When dealing with reimbursement forms, it’s crucial to understand your employer’s specific policies. These guidelines often detail what expenses are eligible, the documentation required, and the timelines for submission. Familiarizing yourself with these policies ensures that you’re not caught off guard, potentially jeopardizing your reimbursement request.

Tax Implications

Employer reimbursement policies can also have significant tax implications. Depending on how your employer handles reimbursements, the funds may be taxable or non-taxable. It’s important to review your reimbursement’s categorization to avoid unexpected tax liabilities.

Another important consideration is whether your reimbursement is classified as a fringe benefit or a reimbursement for actual expenses. This classification will influence how the amounts are reported on your tax returns, and misclassification can lead to complications when tax season arrives. Consult a tax professional if you’re unsure how these policies apply to you.

Timeliness of Submission

Forms must be submitted in a timely manner to ensure they are processed smoothly. Many companies set strict deadlines, and missing these can result in denials or delays of your reimbursement claims.

Consider implementing a routine for submitting your reimbursement forms as soon as expenses are incurred. This practice not only helps you keep track of your submissions but also ensures that you are within the deadlines set by your employer. Being proactive can prevent unnecessary financial strain on your budget and eliminate last-minute stress.

Pros and Cons of Using Reimbursement Forms

Once again, businesses and freelancers are faced with the decision of whether to implement reimbursement forms in their financial processes. Understanding the pros and cons of these forms is crucial for making informed decisions. Below is a breakdown of the advantages and disadvantages.

| Pros of Using Reimbursement Forms | Cons of Using Reimbursement Forms |

| Streamlined financial tracking | Potential for errors in filling out forms |

| Increased accountability | Time-consuming for both employees and finance teams |

| Clear documentation of expenses | Employees may feel overwhelmed by the process |

| Compliance with company policies | Delays in reimbursement can cause frustration |

| Enhances financial transparency | Requires ongoing updates to remain effective |

| Facilitates budget management | May require advanced software or tools |

| Helps to identify areas of overspending | Can slow down the expense reporting process |

| Encourages proper receipt handling | Risk of lost or misplaced forms |

| Standardizes reimbursement requests | Not all employees may understand the form requirements |

| Facilitates timely payment for employees | Inconsistent use may lead to confusion |

Advantages of Reimbursement Forms

Clearly, reimbursement forms bring numerous advantages to your business. They streamline financial tracking by providing a standardized method for submitting expenses, which enhances accountability and facilitates budget management. With clear documentation of expenses, you ensure compliance with company policies and encourage transparency. This not only helps in identifying areas of overspending but also supports quicker reimbursement times for employees.

Disadvantages and Challenges

Forms can be cumbersome, causing potential delays and frustrations for both employees and finance teams. If not filled out correctly, they may lead to errors that complicate the reimbursement process. Additionally, the requirement for clear and organized documentation places extra responsibility on your employees, which can feel overwhelming.

Understanding the challenges associated with reimbursement forms is crucial for improving processes in your organization. You may encounter difficulties such as time-consuming procedures and potential errors due to misunderstanding form requirements. Moreover, delays in reimbursement can result in employee dissatisfaction, especially when they are dependent on timely payments for their business-related expenses. To mitigate these issues, consider providing comprehensive guidance and resources on how to properly complete reimbursement forms, streamlining your financial workflows effectively.

Final Words

The reimbursement form template is an crucial tool for ensuring that you efficiently manage expense claims while maintaining organized records. By utilizing a standardized template, you can simplify the submission process for yourself and your employees. Your careful attention to detail in completing the form will facilitate quicker approvals and ensure that all necessary information is captured. Ultimately, investing time in creating or adopting a well-structured reimbursement form template can save you time and resources, making financial management within your organization smoother and more effective.

Reimbursement Form Template: Everything You Need to Know

In every organization, employees often incur expenses that are necessary for their jobs. To ensure that those expenses are reimbursed in a timely and organized manner, many companies utilize a reimbursement form template. This article will explore what a reimbursement form template is, its benefits, and tips on how to create one that meets your organization’s needs.

What is a Reimbursement Form Template?

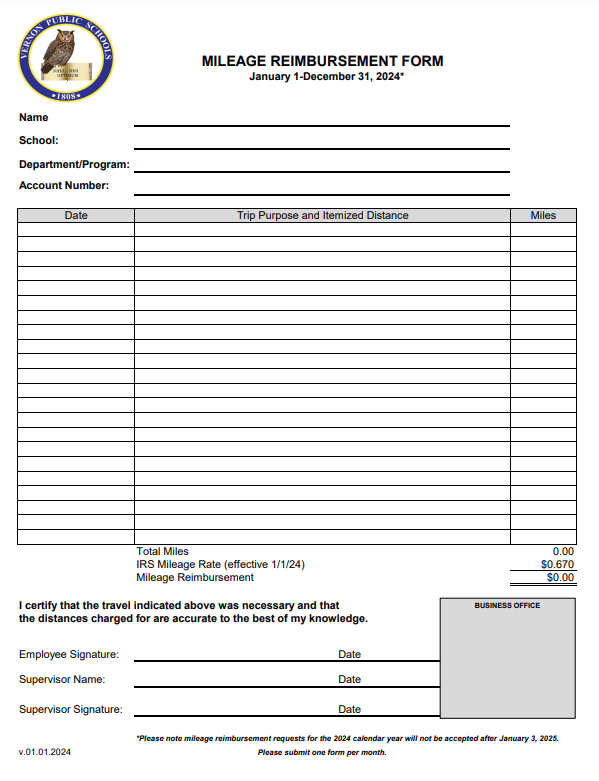

A reimbursement form template is a standardized document used by employees to request reimbursement for expenses they have incurred during their work activities. These expenses can include travel costs, office supplies, meals, and other work-related expenditures. The template typically includes fields for the employee’s information, expense details, and necessary receipts or documentation.

Benefits of Using a Reimbursement Form Template

- Streamlined Proces : A standardized form simplifies the process of submitting and approving reimbursements, reducing the time spent on paperwork.

- Consistency : A template ensures that all necessary information is captured uniformly across all submissions, minimizing confusion and processing errors.

- Enhanced Tracking : This form helps in tracking expenses and budgets, allowing for better financial oversight and control within the organization.

How to Create an Effective Reimbursement Form Template

Creating a reimbursement form template involves a few key steps:

- Identify Necessary Fields : Include vital fields such as employee name, department, date of expense, purpose of the expense, amount sought, and any relevant receipts.

- Maintain Clarity : Use clear and concise language. Instructions or notes can be provided at the top to guide employees on how to fill out the form correctly.

- Check for Compliance : Ensure that the form aligns with company policies regarding expenses and reimbursements.

- Utilize Technology : Consider using software or online tools to create a digital version of the form for ease of access and submission.

Download Reimbursement Form Template

FAQ

Q: What information is typically required on a reimbursement form template?

A: A reimbursement form template generally requires the following information:

– Employee name and ID

– Department

– Date of the expense

– Description and purpose of the expense

– Total amount being claimed

– Receipts or documentation to support the claim

– Signatures or approvals if necessary

Q: How can I customize a reimbursement form template for my organization?

A: To customize a reimbursement form template, consider the following steps:

– Review your company’s reimbursement policies to ensure compliance.

– Add or remove fields based on the specific types of expenses your employees incur.

– Include your company’s logo and branding elements for a professional look.

– Use clear language and instructions to make it easy for employees to complete the form correctly.

Q: Is it necessary to attach receipts with the reimbursement form?

A: Yes, it is typically necessary to attach receipts with the reimbursement form. Most companies require receipts as proof of the expense being claimed. This not only helps in verifying the legitimacy of the expenses but also aids in internal auditing processes. However, some organizations may have specific guidelines regarding what constitutes an acceptable receipt, so it’s advisable to check the company policy.