As an employee, tracking your mileage is crucial to ensure you receive fair reimbursement for your business-related travel expenses. A mileage reimbursement form is a necessary tool to help you do just that. With this form, you’ll be able to accurately record and calculate your mileage, providing proof of your expenses to your employer. In this guide, you’ll learn how to create and use a mileage reimbursement form, what information to include, and tips to make the process smoother. By the end of this article, you’ll be confident in managing your mileage reimbursement and getting the compensation you deserve.

Understanding Mileage Reimbursement Forms

To ensure you’re properly reimbursed for business-related travel expenses, it’s imperative to understand the purpose and functionality of mileage reimbursement forms.

Types of Mileage Reimbursement Forms

You’ll encounter different types of mileage reimbursement forms, each serving a specific purpose:

- Standard Mileage Rate Form: used for calculating reimbursement based on a standard rate per mile.

- Actual Expenses Form: used for tracking and reimbursing actual fuel, maintenance, and other vehicle-related expenses.

- Hybrid Form: combines elements of standard mileage rate and actual expenses forms.

- Electronic Logging Form: used for digital tracking and recording of mileage and expenses.

- Paper Log Form: a manual, paper-based form for recording mileage and expenses.

The type of form you use will depend on your company’s policies and the nature of your business travel.

Assuming you’re familiar with the different types of forms, let’s break down the imperative information you’ll need to include:

| Column 1 | Column 2 |

| Date | Business purpose |

| Odometer readings | Mileage calculation |

| Fuel expenses | Tolls and parking fees |

| Total miles driven | Reimbursement amount |

Importance of Accurate Record Keeping

Record keeping is crucial when it comes to mileage reimbursement forms. Inaccurate or incomplete records can lead to delayed or denied reimbursement, which can negatively impact your cash flow.

This is why it’s imperative to maintain accurate, detailed records of your business-related travel. Make sure to log your miles, fuel expenses, and other relevant information promptly and accurately. Failing to do so can result in lost reimbursement opportunities, which can add up quickly. By keeping accurate records, you’ll ensure you’re reimbursed fairly and efficiently, allowing you to focus on your business rather than worrying about paperwork.

Factors Affecting Mileage Reimbursement

One of the most critical aspects of mileage reimbursement is understanding the various factors that can impact the amount you receive. These factors can significantly influence your reimbursement, so it’s important to be aware of them.

- Business Use vs. Personal Use: This distinction is crucial, as only business-related miles are eligible for reimbursement.

- Mileage Rates and Calculations: The rate at which you’re reimbursed per mile, as well as the method of calculation, can greatly affect your reimbursement amount.

- Record Keeping Requirements: Accurate and detailed records are necessary to support your reimbursement claim.

Perceiving these factors will help you navigate the mileage reimbursement process more effectively.

Business Use vs. Personal Use

To ensure accurate reimbursement, it’s important to differentiate between business and personal use of your vehicle. Only miles driven for business purposes are eligible for reimbursement, so keeping track of personal miles is crucial.

Mileage Rates and Calculations

Business mileage rates vary depending on the country, state, or company. Understanding the rate at which you’re reimbursed per mile, as well as the method of calculation, is vital to ensure you receive the correct amount.

The standard mileage rate in the United States, for example, is 58 cents per mile for 2022. However, this rate may change annually, so it’s important to stay up-to-date with the latest rates. Additionally, some companies may use alternative methods, such as actual expenses or flat rates, which can affect your reimbursement amount.

Record Keeping Requirements

Some companies may have specific record-keeping requirements for mileage reimbursement, so it’s important to familiarize yourself with these guidelines. Accurate and detailed records, including dates, miles driven, and business purpose, are necessary to support your reimbursement claim.

Keeping accurate records can be a daunting task, but using a mileage tracking app or log can simplify the process. Be sure to retain these records for a reasonable period, in case of audits or disputes.

Step-by-Step Guide to Filling Out a Mileage Reimbursement Form

Despite the simplicity of the task, filling out a mileage reimbursement form can be a daunting task for many employees. However, with a clear understanding of the process, you can ensure that you receive fair compensation for your business-related travel expenses.

| Step | Description |

|---|---|

| 1 | Gathering necessary information |

| 2 | Completing the form accurately |

| 3 | Submitting the form for reimbursement |

Gathering Necessary Information

On your next business trip, make sure to keep track of your mileage by recording the odometer readings at the start and end of each trip. You should also keep receipts for fuel, tolls, and parking fees, as these expenses may be reimbursable.

Completing the Form Accurately

For accurate reimbursement, it’s imperative to fill out the form correctly. Ensure that you enter the correct dates, mileage, and expenses, and double-check your calculations to avoid errors.

A common mistake employees make is not separating personal and business expenses. Make sure to only claim expenses related to business travel to avoid any discrepancies.

Submitting the Form for Reimbursement

Completing the form is only half the battle; you must also submit it to the relevant department for reimbursement. Ensure that you attach all supporting documents, such as receipts and mileage logs, to avoid delays in processing.

For instance, if your company has a specific deadline for submitting mileage reimbursement forms, make sure to submit yours well before the deadline to ensure timely reimbursement. Remember to keep a copy of your submitted form for your records, in case of any discrepancies or issues with reimbursement.

By following these steps, you can ensure that you receive fair compensation for your business-related travel expenses. Remember to always check your company’s mileage reimbursement policy for specific guidelines and requirements.

Tips for Maximizing Mileage Reimbursement

Your mileage reimbursement can add up quickly, but only if you’re taking the right steps. Here are some tips to help you maximize your reimbursement:

- Keep accurate records of your mileage, including dates, times, and destinations.

- Understand your company’s policies on mileage reimbursement, including any specific requirements or restrictions.

- Avoid common mistakes, such as failing to log miles or submitting incomplete reports.

Recognizing these tips can help you get the most out of your mileage reimbursement.

Keeping Accurate Records

One of the most important things you can do to maximize your mileage reimbursement is to keep accurate records. This includes logging every mile driven, as well as the date, time, and destination of each trip. Accurate records will help you avoid disputes and ensure that you’re reimbursed for every eligible mile.

Understanding Company Policies

Now that you’re keeping accurate records, it’s time to understand your company’s policies on mileage reimbursement. This includes knowing the reimbursement rate, as well as any specific requirements or restrictions on what can be reimbursed.

Company policies can vary widely, so it’s vital to review your company’s policy carefully. Make sure you understand what is eligible for reimbursement, as well as any documentation or reporting requirements. Familiarizing yourself with company policies will help you avoid mistakes and ensure that you’re reimbursed correctly.

Avoiding Common Mistakes

Reimbursement mistakes can be costly, so it’s vital to avoid them. One common mistake is failing to log miles or submitting incomplete reports. Incomplete reports can lead to delayed or denied reimbursement, so make sure you’re keeping accurate and complete records.

Mistakes can also occur when you’re not familiar with your company’s policies or procedures. Failing to understand company policies can lead to mistakes, so make sure you’re taking the time to review and understand your company’s policy. By avoiding common mistakes, you can ensure that you’re reimbursed correctly and on time.

Weighing the Pros and Cons of Mileage Reimbursement

Once again, as you research into the world of mileage reimbursement, it’s crucial to consider the advantages and disadvantages of this system. To help you make an informed decision, we’ve broken down the key points into a concise table:

| Pros | Cons |

|---|---|

| Encourages accurate record-keeping | May lead to disputes over reimbursement rates |

| Provides a clear understanding of business-related expenses | Can be time-consuming to track and calculate mileage |

| Fairly compensates employees for business-related travel | May not account for other vehicle-related expenses (e.g., maintenance) |

| Helps businesses comply with tax laws and regulations | Requires regular updates to reflect changes in fuel prices or vehicle types |

| Streamlines expense reporting and reimbursement processes | May not be suitable for employees with limited business travel |

| Enhances transparency and accountability | Can be vulnerable to fraudulent claims |

| Supports employee satisfaction and retention | May require additional administrative resources |

| Facilitates budgeting and cost control | Can be complex to implement and manage |

| Complies with IRS guidelines for business-related expenses | May not account for variations in vehicle efficiency or driving habits |

Benefits of Mileage Reimbursement

Reimbursement for business-related mileage can have a significant impact on your bottom line. By implementing a fair and accurate reimbursement system, you can boost employee satisfaction and retention, while also streamlining expense reporting and reimbursement processes.

Drawbacks and Limitations

Assuming you’re considering implementing a mileage reimbursement system, it’s crucial to acknowledge the potential drawbacks. One of the primary concerns is the risk of fraudulent claims, which can lead to financial losses and damage to your business’s reputation.

Understanding the limitations of mileage reimbursement is vital to mitigating these risks. For instance, a mileage reimbursement system may not account for other vehicle-related expenses, such as maintenance or parking fees. Additionally, it may not be suitable for employees with limited business travel or those who use their vehicles for both personal and business purposes. By recognizing these limitations, you can develop a more comprehensive and effective reimbursement system that meets your business’s unique needs.

To wrap up

As a reminder, submitting a mileage reimbursement form is a crucial step in getting compensated for your business-related travel expenses. By following the guidelines and providing accurate information, you can ensure a smooth and efficient process. Remember to keep track of your mileage, gather required documents, and submit your form on time. With these tips, you’ll be able to successfully navigate the mileage reimbursement process and get reimbursed for your expenses. Now, go ahead and take control of your business travel expenses!

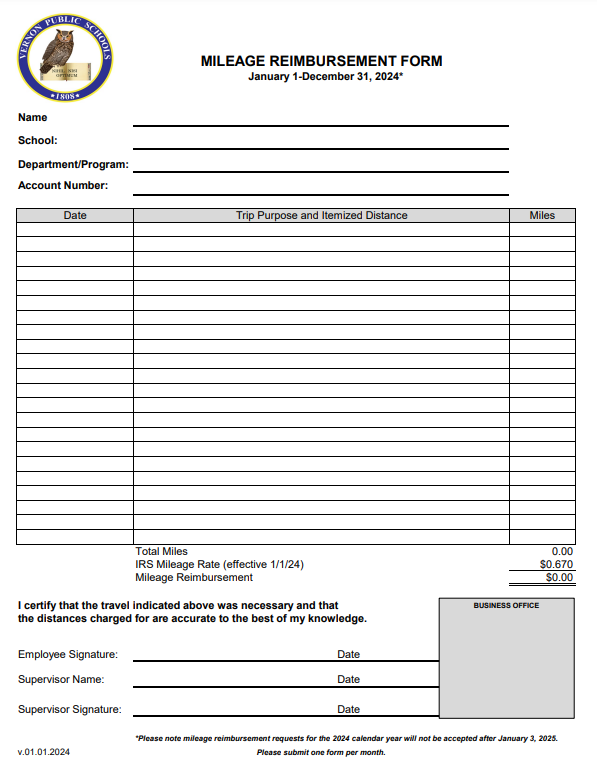

Download Mileage Reimbursement Form

Frequently Asked Questions: Mileage Reimbursement Form

Q: What is a Mileage Reimbursement Form, and why do I need to submit one?

A Mileage Reimbursement Form is a document used to request reimbursement for business-related mileage expenses incurred while using a personal vehicle for company business. You need to submit a Mileage Reimbursement Form to receive compensation for the miles driven, as it serves as proof of the expenses incurred. This form helps your employer track and reimburse employees for legitimate business expenses, ensuring that you are fairly compensated for your travel-related costs.

Q: What information do I need to provide on the Mileage Reimbursement Form?

To complete a Mileage Reimbursement Form accurately, you’ll need to provide the following information:

1. The date and purpose of each trip

2. The starting and ending odometer readings or the total miles driven

3. A detailed description of the business purpose or destination

4. The amount of reimbursement requested (usually calculated using a standard mileage rate)

5. Your signature and date

Additionally, you may need to attach supporting documents, such as receipts for tolls, parking, or fuel, depending on your company’s reimbursement policy. Be sure to review your company’s specific requirements to ensure you provide all necessary information.

Q: How often do I need to submit a Mileage Reimbursement Form, and what is the deadline for submission?

The frequency of submitting a Mileage Reimbursement Form varies depending on your company’s policy. Some employers may require weekly, bi-weekly, or monthly submissions, while others may have a quarterly or annual deadline. It’s crucial to familiarize yourself with your company’s specific reimbursement schedule and deadlines to avoid delays in receiving your reimbursement. Typically, you should submit your form within a reasonable timeframe after incurring the expenses, such as within 30 days, to ensure timely reimbursement.